这个可能是最近股市和房市火爆的原因

BenXia • • 12651 次浏览香港存款下降了790亿港币,新加坡增加了44%到620亿新币

-

#1

股市确实涨了不少但房市火爆从何说起呢

哦 点进去一看原来是中介,理解了 -

BenXia 楼主#2

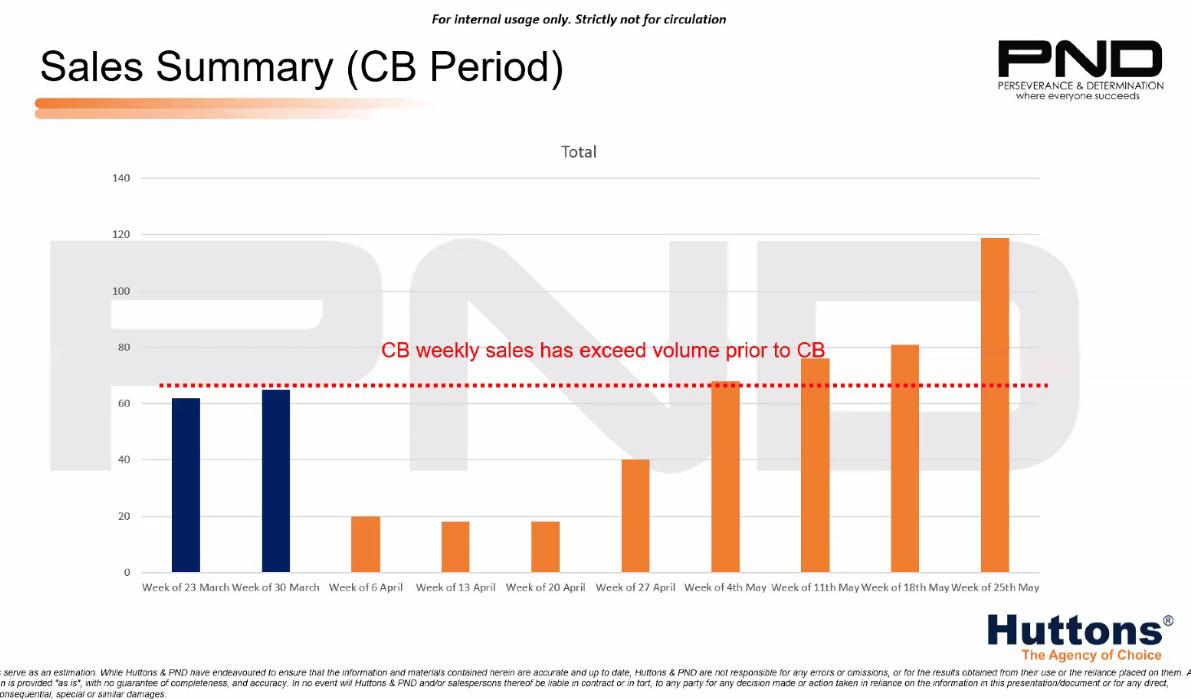

用数据说话,最近地产股也是上涨蛮多的从最新的新盘周销售量来看,5月25日到31日的一周已经卖了119间新盘,约是阻断器前两周61~63间的两倍了,可以看到市场的火热程度,虽然每天新增还四五百个确诊病例,但疫情阻断不了买家的热情

-

#3

买家的身份是?香港,大陆?

-

#4

跟前两周的历史最低点比涨了一点就叫火爆啊,跟去年5月比呢

-

#5

灵魂拷问 非常犀利从property guru 2019 May:

"Developer sales jumped 29.5 percent month-on-month to 952 units (excluding executive condominiums) in May, as buyers were spoilt for choice with nine new projects launched during the month.

New launches more than tripled from the previous month to 1,394 units in May.

On a yearly basis, however, private home sales dropped 15 percent as May 2018 witnessed a major mass market launch – the 520-unit Twin Vew, which moved 454 units, noted Tricia Song, head of research for Singapore at Colliers International."

从彭博2019 May:

“Property sales in Singapore jumped 30% last month (May), led by demand for luxury condos.

A total of 952 private homes were sold in May, up from 735 in April, according to Urban Redevelopment Authority of Singapore data released Monday.

Almost a third of the properties sold fetched more than S$2,000 ($1,460) per square foot, and 48 new homes sold for S$3 million or more, OrangeTee & Tie Pte said.

The city-state’s property market may be benefiting from investors shifting money into safe assets, according to Christine Sun, head of research and consultancy at OrangeTee.

“Geopolitical instability and social unrest around the region, coupled with the intensifying U.S.-China trade war, may trigger ‘flight-to-safety’ behavior among investors,” Sun said. “Many may cut back on more volatile equity investments and choose safer assets, or shift their funds from higher-risk countries to countries with more stable markets like Singapore.” -

BenXia 楼主#6

赞同 还没去年多

-

BenXia 楼主#7

今天银行等大盘股继续涨,但不敢跟了~

-

#8

我是今天开盘杀入的现在已经在套利了

-

#9

但实际上银行股还是看好的估计很快能回到24-25

-

BenXia 楼主#10

勇猛,我本来ocbc做波段的,也弄丢了,损失大了看来还是要长线

-

BenXia 楼主#11

今天杀入了两个S开头的蓝筹股,希望子弹能飞一会

-

BenXia 楼主#12

觉得这一波会涨到啥地步?