去年在最后一天 12 月 31 日做 CPF Top Up 扣税的同学们看过来了

NewOriental • • 14028 次浏览建议去看一下具体的到账时间是 2019 年 12 月 31 日还是 2020 年 1 月 2日。

如果你用的是 Paynow,钱可以当天到账 CPF;如果你用的是 eBanking,需要一个工作日即 1 月 2 日到账。

IRAS 系统默认按实际到账的日子,所以今年报税的时候,最后一天填补的 CPF 可能没有反应到 IRAS 网站上,无法达到扣税的目的。

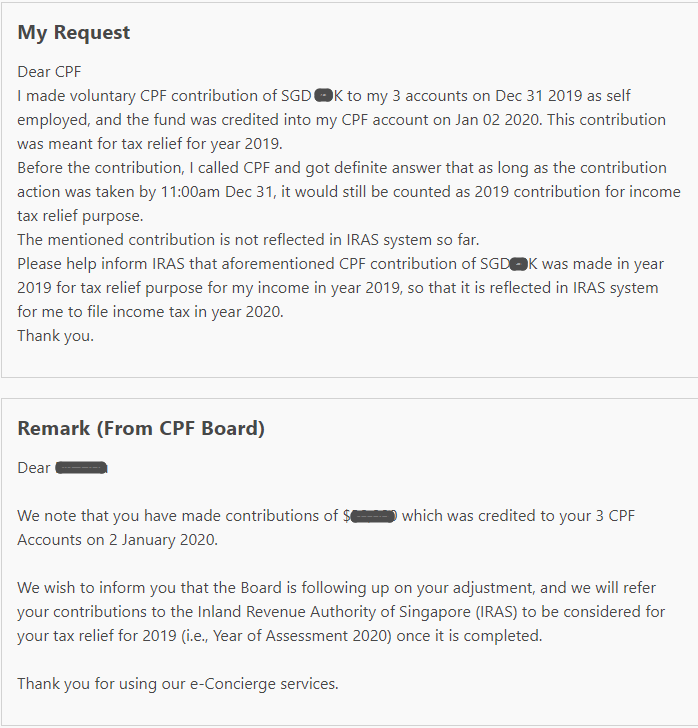

有这种情况的伙伴,请打给 CPF 来进行修改,或者登录 CPF 网站,去 My Requests ——> My e-Concierge 来描述一下。

以下是我提交的描述和 CPF 的回答,供伙伴们参考。

-

#1

所以还是提前一点弄比较好小毛驴自己

-

#2

就是的 干嘛等最后一天

-

#3

自动报税ebanking也没问题。

只要23:59pm之前就行。

Thank you for your enquiry of 3 January 2020.

Yes, rest assured that the answer you received from our colleagues are correct. Online cash top-up applications received on 31 December 2019, by 2359hrs, would qualify for tax relief for Year of Assessment (YA) 2020.

Even though the top-up application shows as it is only processed and credited to your Special Account (SA) in January 2020, online top-up applications received by the Board before the above-stated deadline would be eligible for Tax Assessment of YA 2020.

You can also refer to your tax relief eligibility/amount by following the steps below:

1) Click "My Statement" on the left-navigation panel.

2) Under “Section B”, click on "Retirement Sum Topping-Up Scheme Yearly Statement".

3) Click on “Top-Ups Made to Others” and select the relevant period (by default, it would be from year 2019 to 2020).

4) Click “Proceed -

NewOriental 楼主#4

我也是怀疑就算我不给 CPF 写信要求,最终 IRAS 也是会算作 2019 年的扣税项目因为当初填补前打给 CPF,那边说只要当天操作就可以。并没有说还要回头联系他们做修改。

但是保险起见,还是听从了新的建议,联系 CPF 明确说一下。

毕竟阶梯税率下,几万块的 CPF 就涉及到几千块的个税减免,数额不少。