国大研究显示HDB组屋比99年地契私宅更保值

花生豆 • • 24161 次浏览Old HDB flats weather depreciation better than condos: NUS study

They enjoy constant upgrading from the government’s Home Improvement Programme.

Housing and Development Board (HDB) flats above 30 years are able to withstand against ageing effects and depreciate less compared to private non-landed housing, according to a study by the National University of Singapore (NUS).

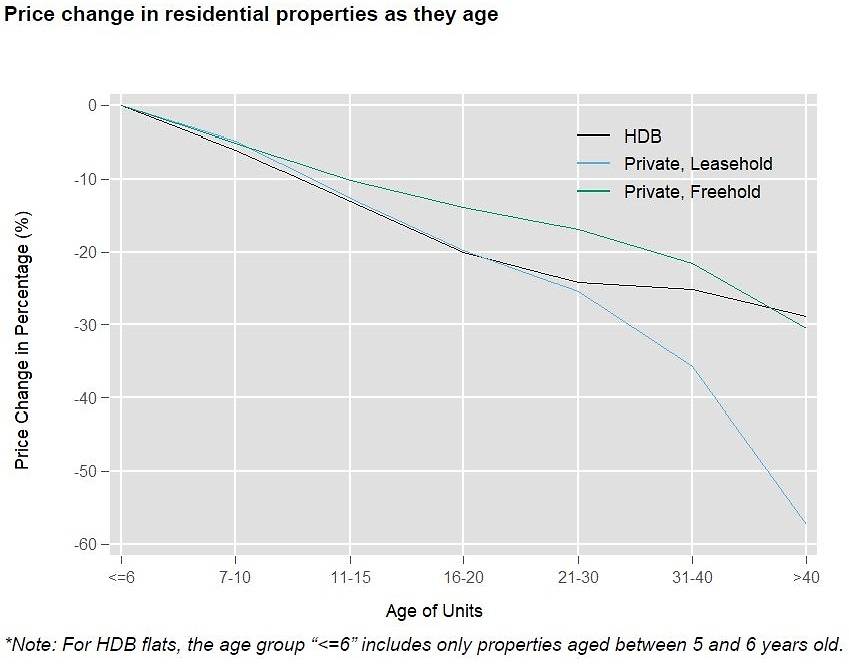

The study, which looked at the depreciation rates of resale houses from 1997 to 2017 using historical resale transaction prices of HDB and condo properties found that the differences amongst the properties appeared only after ten years.

Control measures were also accounted for non-age related factors such as housing size, type, number of housing units in the neighbourhood and distances to the nearest MRT station and the Central Business District (CBD).

Researchers found that within the first ten years, the depreciation rates between the properties were similar. HDB flats depreciated 1% faster than leasehold and freehold non-landed residential properties and were related to building age. After ten years, private freehold residential properties were found to have generally depreciated at a slower rate relative to private leasehold residential housing and HDB flats.

Once housing reached 21 years and above, the depreciation rate for HDB flats stood at approximately 3%, whilst freehold private residential property prices depreciated by more than 10%. Leasehold private residential property prices depreciated by more than 30% once they reached the same age.

“The increasing ageing effects of private properties above 30 years old is probably due to lack of maintenance of the building and its surroundings,” NUS associate professor and the study’s co-author Sing Tien Foo said in a statement. “HDB flats enjoy the benefits of upgrading efforts such as the Singapore government’s Home Improvement Programme that help reduce the ageing effects more effectively than private properties.”

He added that the ageing problem is more serious for private leasehold property owners who face both ageing and lease decaying effects, given that ageing can speed up the economic obsoleteness of older buildings.

Sumit Agarwal, Low Tuck Kwong distinguished professor in finance from the NUS Business School, noted that redevelopment schemes and subsidy grants of up to $50,000 for first-time buyers of resale flats further slow the price depreciation of older HDB flats.

-

花生豆 楼主#1

Old HDB flats weather depreciation better than condos: NUS studyThey enjoy constant upgrading from the government's Home Improvement Programme.

Housing and Development Board (HDB) flats above 30 years are able to withstand against ageing effects and depreciate less compared to private non-landed housing, according to a study by the National University of Singapore (NUS).

The study, which looked at the depreciation rates of resale houses from 1997 to 2017 using historical resale transaction prices of HDB and condo properties found that the differences amongst the properties appeared only after ten years.

Control measures were also accounted for non-age related factors such as housing size, type, number of housing units in the neighbourhood and distances to the nearest MRT station and the Central Business District (CBD).

Researchers found that within the first ten years, the depreciation rates between the properties were similar. HDB flats depreciated 1% faster than leasehold and freehold non-landed residential properties and were related to building age. After ten years, private freehold residential properties were found to have generally depreciated at a slower rate relative to private leasehold residential housing and HDB flats.

Once housing reached 21 years and above, the depreciation rate for HDB flats stood at approximately 3%, whilst freehold private residential property prices depreciated by more than 10%. Leasehold private residential property prices depreciated by more than 30% once they reached the same age.

“The increasing ageing effects of private properties above 30 years old is probably due to lack of maintenance of the building and its surroundings,” NUS associate professor and the study’s co-author Sing Tien Foo said in a statement. “HDB flats enjoy the benefits of upgrading efforts such as the Singapore government’s Home Improvement Programme that help reduce the ageing effects more effectively than private properties.”

He added that the ageing problem is more serious for private leasehold property owners who face both ageing and lease decaying effects, given that ageing can speed up the economic obsoleteness of older buildings.

Sumit Agarwal, Low Tuck Kwong distinguished professor in finance from the NUS Business School, noted that redevelopment schemes and subsidy grants of up to $50,000 for first-time buyers of resale flats further slow the price depreciation of older HDB flats. -

#2

人生短短数十年,该享受就要享受呀本来私宅就是花更多的钱去享受的。

-

#3

楼主真好人太喜欢这个研究了

哈哈哈哈 -

#4

享受得起当然享受享受不起还不能看看文章自嗨一下。。。

-

#5

为赋新诗强说愁怎么不研究买自行车比汽车更保值,根本不用油的

-

#6

请问NUS教授住公寓还是HDB呢?请先自清一下。

-

#7

注意1997 to 2017 年数据不愧是教授,试试看1998-2018,保证结果相反。

-

花生豆 楼主#8

More details from channelnewsasia

https://www.channelnewsasia.com/news/singapore/hdb-flats-depreciate-better-private-non-landed-housing-nus-study-11237604

The study was co-authored by a team at NUS, consisting of Prof Sing, Prof Agarwal, NUS Business School professor Low Tuck Kwong and PhD student Zhang Xiaoyu.

这图表太吓人了.

-

#9

这就是你们和NUS教授的差距作为教授,需要考虑到社会影响,要营造和谐社会。新加坡80%的人都住hdb,如果教授研究出来发现私宅更加保值增值,那就会刺激到大多数人的神经,影响社会稳定和谐。教授研究的结果,要根据社会需要。

-

#10

看到这个图,知道叫兽这个词怎么来了它只比较了不同时期的价格,去掉了组屋和公寓的升值部分。

-

#11

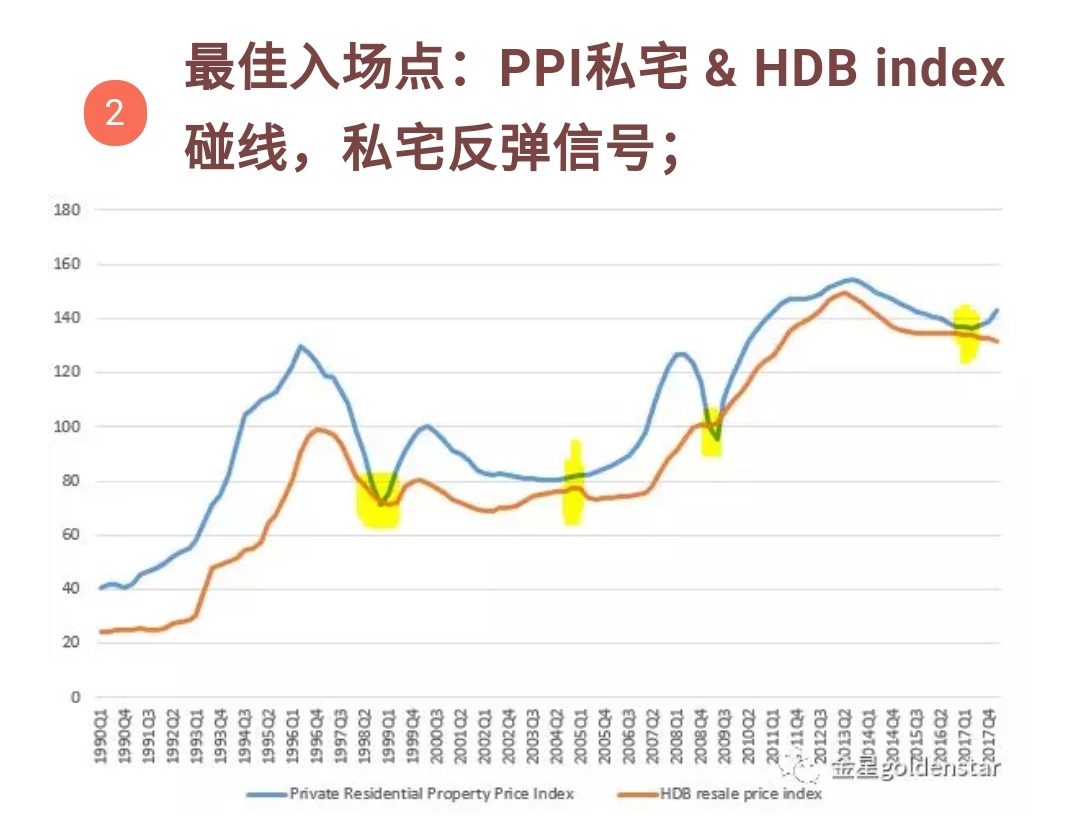

狮王碰线图和叫兽图孰真孰假

-

#12

豆哥你是来逗大家玩的吧不会真相信吧。。。

-

#13

shafa撕逼大战一触即发

-

花生豆 楼主#14

有趣的是国家发展部长貌似非常认可这个碰线理论

https://sg.finance.yahoo.com/news/lawrence-wong-property-price-indexes-114624821.html

-

#15

帮顶坐等大神来科普

-

#16

国大研究在坡上的意义就等同于CCTV在中国的报道吧

-

#17

主要是前一段时间,由房屋经纪主导了一波组屋99年后归零的舆论,试图引导大众抛弃组屋,多买公寓。

所以教授们用数据研究来说明,要买也要买free hold的,99年公寓还不如组屋呢 -

#18

中科院社会研究所CCTV是档的喉舌

可不是用来擦屁股的草纸 -

#19

不要这样嘛我还是很崇拜中科院的啊!

-

#20

我觉得很正常啊!depreciation的参照是什么?

房产本身并没有价格减值的现象。 无论40年的组屋或是公寓,当年只有几万十几万的价格。

用新房价格做比较,那么新公寓价格涨幅高过新组屋涨幅。 就会造成公寓的新-旧价差多过新-旧组屋价差。这很正常啊,新组屋有政府津贴,旧组屋是市场价,本来5年组屋上市就会有个涨价。 再加上组屋价格浮动相对要小,新-旧对比度肯定要比公寓小很多。

但这和旧公寓对比旧组屋升值速度的快慢没有直接关系。 只是数据分析的解释方向而已。

顺便提醒一下,不论组屋还是公寓,价格的产生,通常是由房屋本身主导的。 但是价值上,投资型坛友,在心里上,需要同时具有房屋/土地两个概念,才能更好地判断和寻找具有价值的投资标的。 -

#21

社科院中科院沒有社會學所。是社科院。中科院躺著中槍。

-

#22

哎哟,少群主抬爱了

-

#23

很有价值学习了,谢谢分析!

-

#24

我也很崇拜中科院!我也很崇拜中科院!

-

#25

确实社科院社科院和中科院性质不一样

-

#26

握手握手您家有儿子不?几岁啦?相个娃娃亲?亲家志同道合是很好的 @-@

-

#27

记错了 对不起中科院我为它默哀三秒钟

-

#28

由爱生恨进不了中科院

只能贬低它了 -

#29

其实根本不用研究不考虑房产增值只考虑时间贬值的话,就是一个四分之一圆弧。综合看住5年以上卖掉是最佳选择。

-

#30

不差钱的话谁买二手房啊同样的钱,买15年的旧房可以1200尺,新房连800尺都买不到。

同样住5年,对比的是新房憋屈得住五年不贬值vs旧房宽松得住5年贬值5%-10%