选择UOB Repricing Packages

新小战士 • • 14701 次浏览今天拿到UOB发来的repricing packages,请问广大的狮城帮er选哪个配套比较合适呢?

Option A : Fixed Rate Package with 2 Years Lock-in Period - 1X free conversion (Min $100k) after 12M from conversion effective date

(For completed residential properties only with a minimum loan amount of S$100,000)

Year 1 : 1.70% Fixed

Year 2 : 1.70% Fixed

Year 3 & Thereafter : 1.70% (ML+0.85%)

*Mortgage Rate (“ML”) is the Bank’s prevailing UOB MLC Rate_PTE which is currently at 0.85% p.a.

Partial Redemption Penalty - 1 X penalty fee waiver per year for Capital partial prepayment up to 10% of conversion loan amount within the lock in period

*1.50% on prepaid amount within lock-in period from conversion date.

*Partial Repayment is subjected to 1 month written notice.

*No partial repayment is allowed when the outstanding loan tenor is below 5 years.

Full Redemption Penalty - Waiver of full loan redemption fee due to sales of property within lock in period

*1.50% on redeemed amount within lock-in period from conversion date.

*Full redemption is subjected to 3 months written notice.

Option B: Fixed Rate Package with 3 Years Lock-in Period - 1X free conversion (Min $100k) after 24M from conversion effective date

(For completed residential properties only with a minimum loan amount of S$300,000)

Year 1 : 1.78% Fixed

Year 2 : 1.78% Fixed

Year 3 : 1.78% Fixed

Year 4 & Thereafter : 1.78% (ML + 0.93%)

*Mortgage Rate (“ML”) is the Bank’s prevailing UOB MLC Rate_PTE which is currently at 0.85% p.a.

Partial Redemption Penalty: - 1 X penalty fee waiver per year for Capital partial prepayment up to 10% of conversion loan amount within the lock in period

1.50% on prepaid amount within 3 years from date of conversion.

Partial Prepayment is subject to 1 month written notice.

Full Redemption Penalty: - Waiver of full loan redemption fee within lock in period if due to sales of property

1.50% on redeemed amount within 3 years from date of conversion.

Full redemption is subject to 3 months written notice.

Option C: Fixed Rate Package with 5 Years Lock-in Period

(For completed residential properties only with a minimum loan amount of S$100,000)

Year 1 : 1.80% Fixed

Year 2 : 1.80% Fixed

Year 3 : 1.80% Fixed

Year 4 : 1.80% Fixed

Year 5 : 1.80% Fixed

Year 6 & Thereafter : 2.00% (ML + 1.15%)

*Mortgage Rate (“ML”) is the Bank’s prevailing UOB MLC Rate_PTE which is currently at 0.85% p.a.

Partial Redemption Penalty:

1.50% on prepaid amount within 3 years from date of conversion.

Partial Prepayment is subject to 1 month written notice.

Full Redemption Penalty: - Waiver of full loan redemption fee due to sales of property within the 5 years lock in period

1.50% on redeemed amount within 3 years from date of conversion.

Full redemption is subject to 3 months written notice.

-

新小战士 楼主#1

还有一个option D是不是现在选择option D比较合适呢?

Option D : Floating Rate Package with 2 Years Lock-in Period – Free conversion if Bank’s mortgage rate increase within the lock in period

(For completed residential properties only with a minimum loan amount of S$100,000)

Year 1 : 1.60% (ML + 0.75%)

Year 2 : 1.60% (ML + 0.75%)

Year 3 & Thereafter : 1.60% (ML + 0.75%)

*Mortgage Rate (“ML”) is the Bank’s prevailing UOB MLC Rate_PTE which is currently at 0.85% p.a.

Partial Redemption Penalty

*If loan outstanding fall below $200,000 after partial prepayment within lock-in period from conversion date, a penalty of 1.50% on prepaid amount will be imposed.

*Partial Repayment is subjected to 1 month written notice.

*No partial repayment is allowed when the outstanding loan tenor is below 5 years.

Full Redemption Penalty

*1.50% on redeemed amount within lock-in period from conversion date.

*Full redemption is subjected to 3 months written notice. -

#2

保守你就选Option C 否则你选sibor

-

#3

sibor选项在哪儿?

-

#4

你这个1.7 2yrs fixed的挺好的了我问了都一个礼拜了 现在uob refinance给的最低1.72

-

#5

律师费多少呀?UOB只给了我两个package, 1.78三年和1.7 两年。 不过律师费要500(据说原价800). 是不是300是正常价格?

-

#6

Repricing不用律师费,$500是手续费

-

#7

谢谢回复那请问500手续费是合理价格么

-

#8

也收到了UOB的Reprice Package,大家帮我看一下没有Top,也没过lock-in

OPTION A: FLOATING (2 YEARS PENALTY PERIOD)

Free conversion is applicable only if you are before the date of TOP

(For BUC properties, min $200K Loan outstanding)

Yr 1: 1.70% (ML + 0.85%)

Yr 2: 1.70% (ML + 0.85%)

Thereafter: 1.70% (ML + 0.85%)

ML is UOB MLC RATE is currently at 0.85% per annum

OPTION B: 3 MONTH SIBOR (2 YEARS PENALTY PERIOD)

Free conversion is applicable only if you are before the date of TOP

(For BUC properties, min $200K Loan outstanding)

3 Month SIBOR as at 18 Mar 2020 = 0.99490%

Yr 1: 3 Month SIBOR + 0.63%

Yr 2: 3 Month SIBOR + 0.63%

Thereafter: 3Month SIBOR + 0.63%

Option C:

Reprice Fee: $500

Yr 1: 3 Month SIBOR + 0.50%

Yr 2: 3 Month SIBOR + 0.50%

Thereafter: 3Month SIBOR + 0.50%

Option A,B 不用交Reprice Fee -

#9

不换银行是合理的。都要收一笔。

-

#10

1.7% p.a貌似看到最好的了还有小伙伴知道更低的固定利率吗?

-

#11

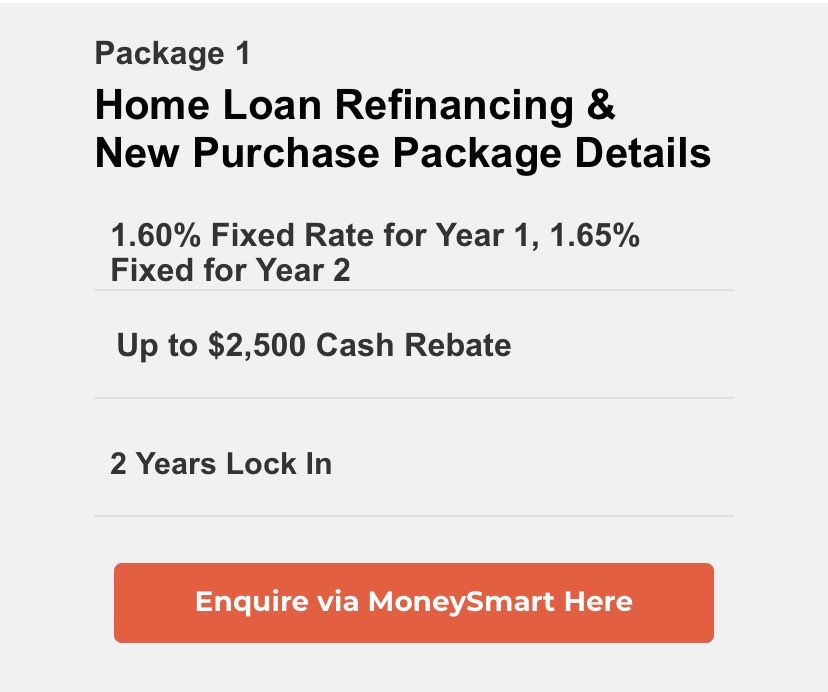

Maybank, 1.65% fixed period 2 years如上。

-

#12

感觉这个更好:)