美股什么时候抄底?

dazzle • • 14969 次浏览In a dataset dating back to 1928, returns of -4% or worse for the S&P 500 have only occurred 146 times. Since the end of World War II, we have only seen 51 days this weak in 75 years. Down 4% days are rare, and they tend to cluster in economic recessions.

Putting together the cumulative weak days on Monday, Tuesday, and Thursday and we are entering historic territory. The S&P 500 has shed 10.7% over these past four trading sessions.

. We have not had a four day selloff this bad since the financial crisis in 2008. (-17.2% in four days ending October 9th, 2008)

. Before that, we had not experienced as bad of a 4 day stretch since July 2002 when the announcement of accounting regularities at Worldcom spooked a market already grappling with the tech bubble deflation and post-9/11 uncertainty. (-11.96% in four days ending July 23, 2002)

. Before the 2002 sell-off, it was the worst four day period since August 1998 when global assets were frightened by the prospect of a Russian debt default. (-12.41% ending August 31, 1998)

. Prior to 1998, you have to go back to the historic 1987 market sell-off. (-28.5% ending October 19th, 1987)

. Before 1987, you have to go back a quarter-century to the Kennedy Slide of 1962. (-10.97% ending May 28, 1962)

. Prior to that sell-off, you have to go back to May 1940, which an astute reader recently pointed out was the German blitzkreig into France (-15.1% through May 14, 1940)

---

-

#1

我准备小额多次抄底我用的是ib,交易费用极低,所以每次拿不了很准的情况下,就小额抄底,例如昨天一开盘我就抄了5股QQQ。

-

dazzle 楼主#2

5股就是10W刀

已经录了3k了吧

你打算接下来怎么加?

-

#3

就在今日 机不可失

-

dazzle 楼主#4

牛市买纳斯 熊市买标普我记得巴老讲过

-

#5

请教ib全称是什么,交易费多少呀?

-

#6

一股不是200多吗

-

#7

太抬举我了QQQ一股200出头,5股才1000刀呀,所以说是小额。

-

#8

我已经彻底放弃个股了买的都是QQQ,SPY,XLV等等的etf。

-

dazzle 楼主#9

哦 想成手了对不起,想成手了,IB每次都是default 给100股的量,100股和1股都是收1块的commission对吧~

-

dazzle 楼主#10

买指数省心嗯,感觉买指数挺好的,炒个股的费心费力,都是大神或者牛人,我也是打算盯着指数买。

-

#11

买美股手续费多少啊IB是最便宜的吗

-

#12

看图形估计18000左右是这一波的底部不过要慢慢走,美股向来是熊短牛长,不过确定熊市以后还是得走4-5个月吧。今年6-7月的时候开始找找有没有机会然后慢慢买入吧,现在市场上等着抄底的人太多,不适合买。等大家都放弃抄底了以后再找机会比较好。

-

#13

请问大家在新加坡怎么开ib的fully disclosed broker账户呀在ib的fully disclosed broker开户合适吗? 推荐哪一家啊

-

#14

其实没有什么几时抄底的问题基本原则是不涨不买,不跌不卖

没有抄底逃顶的说法

操作对头,任何时候都是好时候

持股的时候,做好保护措施-有很多工具可以用,这点美国比较强 -

#15

有特朗普在,以及2008年的经验,这次应该不会跌太多我认为上周五就是底了。25000是个很强的支撑。

-

#16

据我观察,今晚有几百点反弹未必是底

好股票可以买起,慢慢倒 -

#17

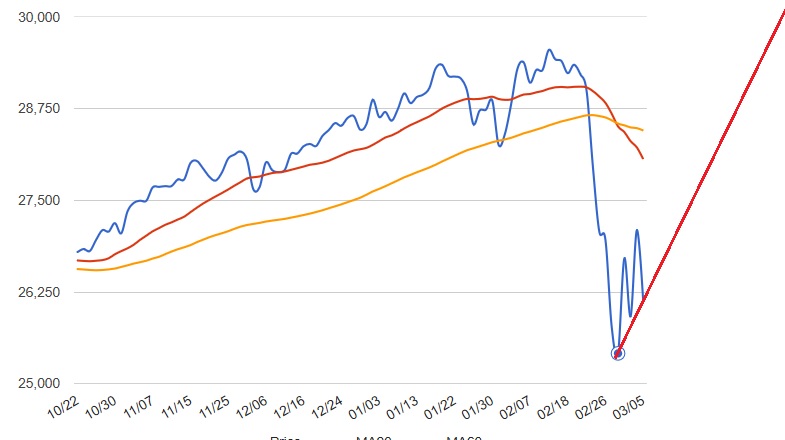

忍不住 数据说话(峰峰值差)2007.10 .13930

2009.3.7600

跌6330,或45%+

2020.2.12 29520

2020.2.28 24720

跌4800.或 15 16%+

就是这样子 -

dazzle 楼主#18

看今天亚洲市场像是靠谱了今天亚洲市场都还行,周五估计会是个阶段低点了,之后怎么样只能看疫情怎么发展。

今天A股很暴躁,人们对政策红利的期待和信心很高涨。 -

#19

只是感觉a股有点过于乐观港新比较实际

至少还要看两周 -

#20

三天已经反弹了近2000点呵呵

-

#21

呵呵高兴了

还要血洗几轮

长进点,先讲,不要看到结果才叫

现在的位置继续空

无论降息放水

这就是所谓的割草

光future今天就收了几百点=多少?

果然上涨的股神 -

#22

我都已经完成套利了,还看毛结果啊都说了上周五是底。

会不会有新的底,要就要随时观察了。

说一句几月见低,或者多少是底都没啥意义。错过了太多机会。 -

#23

哈哈,恭喜啊你每次都事后套利

房子买了多少,车子几辆

有没有财务自由

真羡慕你,要好好向你学习 -

#24

早上起来轻轻的笑下

-

#25

anyway 1200-950=250所以,你懂的

-

#26

就事论事,别扯别的自由不自由也不至于告诉你啊。

-

#27

今天开始买回了,上周的已经套利了

-

#28

南子就是這麼理解的,如圖

-

#29

你挺乐观的。。。我看不到那么远,我就是先看眼前的波段了。

-

#30

这就和2毛钱买AM,然后25左右卖掉一样就算是崩溃的市场,都有反弹的。你自己抓不住也没关系,但你不能说那些做波段的人看错方向了。

-

#31

你說得太對了做波段, 永遠都會賺錢的

沒有對和錯,賺錢是硬道理

低買高賣和高賣低買,究竟一不一樣, 那不一樣

南子老是搞不清什麼叫趨勢, 趨勢交易爲什麼安全可靠 -好煩,維女子與小人難養也

真的 -

#32

小盆友,要不要那么敏感啊有说过谁对谁错吗?只是各抒己见而已吧。

况且,股市投资,哪有常胜军,永远正确赚钱的,如果这一关过不了,不要入圈

风投圈都知道创业公司的存活率不到5%,难道其他95%都错了?

这里谈的是基本面,由于经济活动受限(航运 空运,生产,流通。。-不要和我争网络医疗机会来了,问题层次不同),无论怎么刺激和以前的效果会大不同,对不对,看看。

和amal一样,不是几毛买和几毛卖的问题,那只股根本就不该介入的问题 就是因为基本面

现在的股市根本不是抄底的问题,而是避险,如何避险,有各种工具

趋势,趋势,和大势才是成功率的保证

明白? -

#33

对呀,按技术流的说法(大概)后日高点高于前日高点 后日低点也高于前日低点,反转势头已成,应该积极介入抄底

然鹅,如果,万一,可能,接下来的低点低于前两日低点 高点低于前两日高点,是不是叫头肩形态?那时候又怎么说?

是不是该说要5波出齐?

女人都只有两波

等5波,怕是等到花儿也谢了也等不到咯 -

#34

耶?行家耶幾時約你跟南子上上課

她基本不相信我說的也 -

#35

承蒙看得起如果今夜再跌>700点,我们再约

也许非农好,跌幅窄,也许差加上新肺,就翻倍(1400+/-) -

#36

应该靠谱了下超过700点开市

-

dazzle 楼主#37

美股什么时候抄底?In a dataset dating back to 1928, returns of -4% or worse for the S&P 500 have only occurred 146 times. Since the end of World War II, we have only seen 51 days this weak in 75 years. Down 4% days are rare, and they tend to cluster in economic recessions.

Putting together the cumulative weak days on Monday, Tuesday, and Thursday and we are entering historic territory. The S&P 500 has shed 10.7% over these past four trading sessions.

. We have not had a four day selloff this bad since the financial crisis in 2008. (-17.2% in four days ending October 9th, 2008)

. Before that, we had not experienced as bad of a 4 day stretch since July 2002 when the announcement of accounting regularities at Worldcom spooked a market already grappling with the tech bubble deflation and post-9/11 uncertainty. (-11.96% in four days ending July 23, 2002)

. Before the 2002 sell-off, it was the worst four day period since August 1998 when global assets were frightened by the prospect of a Russian debt default. (-12.41% ending August 31, 1998)

. Prior to 1998, you have to go back to the historic 1987 market sell-off. (-28.5% ending October 19th, 1987)

. Before 1987, you have to go back a quarter-century to the Kennedy Slide of 1962. (-10.97% ending May 28, 1962)

. Prior to that sell-off, you have to go back to May 1940, which an astute reader recently pointed out was the German blitzkreig into France (-15.1% through May 14, 1940)

---

该帖荣获当日十大第7,奖励楼主6分以及9狮城帮币,时间:2020-03-01 22:00:07。

---

该帖荣获当日十大第8,奖励楼主4分以及6狮城帮币,时间:2020-03-06 22:00:08。