EC转手能起多少?

西芹妈 • • 50352 次浏览想问下要是新EC住5年后转手,一般屋价会起多少%?

---

-

#1

没法回答。。。 目测至少50%起

-

#2

保守来说15-20%,具体的要看大市

-

西芹妈 楼主#3

不如组屋我的bto 5年起了55%,这样我还应该换吗?还有要是卖了EC,还能买回组屋吗?我的bto 5年起了55%,这样我还应该换吗?还有要是卖了EC,还能买回组屋吗?

-

#4

2010年前买的都是赚,现在买bto不会好过EC这么多,如果保持现状,预计现在新的组屋在转售时增值也是在同样范围10-25%。这么多,如果保持现状,预计现在新的组屋在转售时增值也是在同样范围10-25%。

-

#5

卖了EC,可以买回二手组屋。新组屋要看还有没有资格,如果有资格,要等卖掉ec后3片个月才能申请。新组屋要看还有没有资格,如果有资格,要等卖掉ec后3片个月才能申请。

-

西芹妈 楼主#6

那我该怎么做可以给点建议吗?现在的组屋就地点不好,但确实买得很便宜。想改善下居住环境,但工薪族要留组屋买多间公寓估计要存很久。而且要多还10%的买家税可以给点建议吗?现在的组屋就地点不好,但确实买得很便宜。想改善下居住环境,但工薪族要留组屋买多间公寓估计要存很久。而且要多还10%的买家税

-

#7

目前的情况说50%太夸张了!15-20% 靠谱!15-20% 靠谱!

-

#8

目测楼主希望看到这样的数字, 你懂得

-

#9

哈哈所以说现在祖屋已经偏离了“居者有其屋”的宗旨而变成了牟利工具。新加坡可不能再控制外来人口流入了啊,否则谁来为大家接盘?所以说现在祖屋已经偏离了“居者有其屋”的宗旨而变成了牟利工具。新加坡可不能再控制外来人口流入了啊,否则谁来为大家接盘?

-

#10

楼主问的是EC, 楼上联想过于丰富了

-

#11

EC也是要卖给外国人啊本地人都可以BTO或者一手EC,谁没事买二手啊?本地人都可以BTO或者一手EC,谁没事买二手啊?

-

#12

我是说拿了PR身份的外国人。拿了PR身份的外国人。

-

#13

不要捣乱。要是50%,那你赶紧去拿个SC,等符合条件了就立刻买:)要是50%,那你赶紧去拿个SC,等符合条件了就立刻买:)

-

西芹妈 楼主#14

有新EC要等3年,很多人要组织家庭生孩子会考虑。新EC要等3年,很多人要组织家庭生孩子会考虑。

-

西芹妈 楼主#15

目前住的现在的是BTO,刚MOP.只剩一次买新组屋的机会。所以在考虑新EC现在的是BTO,刚MOP.只剩一次买新组屋的机会。所以在考虑新EC

-

#16

你买EC算second timer了吧?要给不一样的税了吧要给不一样的税了吧

-

西芹妈 楼主#17

levy要还4万resale levy. 首付23%,那3%是买家税吧要还4万resale levy. 首付23%,那3%是买家税吧

-

#18

理想的当然是保留组屋,做hdb transfer ownership,然后薪水高的那个出去买第二套公寓,住公寓,出租组屋,租金还贷款。

实际上如果负担太重,又想提升生活质量,选择就是买新EC。如果以后政府放宽政策,薪水有很大提高,还是一样可以购买第二套公寓的。而且不要忘记,ec私有化后,可以做cash out,比较灵活。赶上下一波大市,公寓的收益会高过HdB很多然后薪水高的那个出去买第二套公寓,住公寓,出租组屋,租金还贷款。

实际上如果负担太重,又想提升生活质量,选择就是买新EC。如果以后政府放宽政策,薪水有很大提高,还是一样可以购买第二套公寓的。而且不要忘记,ec私有化后,可以做cash out,比较灵活。赶上下一波大市,公寓的收益会高过HdB很多 -

#19

不需要levy的EC还是有的

-

#20

杰伦的票买好了 回家给我报销

-

#21

我想问一下。。您觉得单身申请二房式BTO的 income ceilling 还会继续起吗

-

西芹妈 楼主#22

假如如果取消了公寓的ABSD,是留组屋,买小公寓比较好如果取消了公寓的ABSD,是留组屋,买小公寓比较好

-

西芹妈 楼主#23

地点不近地铁不喜欢,盛港傍鹅不喜欢不近地铁不喜欢,盛港傍鹅不喜欢

-

#24

skypark靠近地铁且没有levy但只剩下4+1和5房了,快要top最近在清仓甩卖~但只剩下4+1和5房了,快要top最近在清仓甩卖~

-

#25

EC地点好并靠近MRT的很少见1. Twin Fountains

2. Forestville

3. Ecopolitan

4. Sea Horizon

5. Waterwoods

6. Skypark Residences

7. Bellewoods

8. Bellewaters

9. LakeLife

10. The Terrace

11. The Amore

因为是2013年12月之前拿地的项目才不需要levy,这些项目都卖得七七八八了。

1. Twin Fountains

2. Forestville

3. Ecopolitan

4. Sea Horizon

5. Waterwoods

6. Skypark Residences

7. Bellewoods

8. Bellewaters

9. LakeLife

10. The Terrace

11. The Amore

因为是2013年12月之前拿地的项目才不需要levy,这些项目都卖得七七八八了。 -

#26

感觉最近5年都不会,薪水没增加这么快的

-

西芹妈 楼主#27

EC等EC建好后,我卖BTO所得收到的CPF和现金是不是可以在MOP后用来买公寓?等EC建好后,我卖BTO所得收到的CPF和现金是不是可以在MOP后用来买公寓?

-

#28

如果现金足够,建议直接购买公寓,保留投资回报率较高的祖屋

-

西芹妈 楼主#29

就是没钱而且BTO要还完了才能拿80%的贷款吧而且BTO要还完了才能拿80%的贷款吧

-

#30

这样你就要好好算算了最好的方案是保留租屋,买公寓。如果买ec,以后只能再买condo,不要想着将来卖ec,再买hdb,那太折腾了。所以,ec尽量买大的。其实目前算是很好的入场时机。

最好的方案是保留租屋,买公寓。如果买ec,以后只能再买condo,不要想着将来卖ec,再买hdb,那太折腾了。所以,ec尽量买大的。其实目前算是很好的入场时机。 -

#31

EC 需要的时间太长了假如现在买EC 3年后建好,然后再5年MOP ,这都8年了 然后卖了再买公寓,如果已经35岁以后就不建议这样折腾了 ,8年后也贷不了多少了 。 年轻可以折腾。如果组屋贷款不多就狠下心,多存几年前,还了组屋,够公寓首付,直接上二套的了。

买EC就要有心理准备,以后就这么一套EC了。啰嗦很多,希望能理解。假如现在买EC 3年后建好,然后再5年MOP ,这都8年了 然后卖了再买公寓,如果已经35岁以后就不建议这样折腾了 ,8年后也贷不了多少了 。 年轻可以折腾。如果组屋贷款不多就狠下心,多存几年前,还了组屋,够公寓首付,直接上二套的了。

买EC就要有心理准备,以后就这么一套EC了。啰嗦很多,希望能理解。 -

#32

买了ec的人很肯定的说直接买公寓, 然后组屋出租。 现在我们都很后悔买了EC, 组屋卖掉太可惜了,。直接买公寓, 然后组屋出租。 现在我们都很后悔买了EC, 组屋卖掉太可惜了,。

-

#33

预算充足肯定直接上二套公寓啊有疑问肯定是预算不足嘛,所以很多人才上EC的,压力没有那么大有疑问肯定是预算不足嘛,所以很多人才上EC的,压力没有那么大

-

#34

其实是看budget同样的budget, 可以买到3个卧室的ec, 也可以买到2个卧室的condo。 不是condo就一定比ec贵的。同样的budget, 可以买到3个卧室的ec, 也可以买到2个卧室的condo。 不是condo就一定比ec贵的。

-

#35

我有个疑问。假如我35岁, 现在住4 room HDB, 有10 年贷款未还。CPF除了还贷,每月有几百剩余,现金200K, 面临的选择:

1. 保留HDB, 买3 bedroom Condo,有两个孩子,还有父母要临时来住,所以自住的Condo不能太小。这样的Condo要1.2m左右, 首付(1.2m*23%)所用现金不够,还要借外债。剩下要还 960k Condo贷款, 借30 年(一直要工作到65岁), 利率2%, 每月还$3548。一旦利率涨到4%, 每月还贷 $4583。HDB租金收入抛去空置期,每月$2000。两厢抵, 每月要花$2000cash, 直到10年以后。这种前提是银行会借给960k。

2. 卖HDB,买 EC. 4 bedroom, 总价960k。首付200k,卖出HDB价格减去剩余HDB贷款=300k,所以贷款需要960-200-300=460k, 贷款25年,假设利息3%, 月付$2181,CPF可以cover95%,几乎不需要cash。

大家会选哪一种?

假如我35岁, 现在住4 room HDB, 有10 年贷款未还。CPF除了还贷,每月有几百剩余,现金200K, 面临的选择:

1. 保留HDB, 买3 bedroom Condo,有两个孩子,还有父母要临时来住,所以自住的Condo不能太小。这样的Condo要1.2m左右, 首付(1.2m*23%)所用现金不够,还要借外债。剩下要还 960k Condo贷款, 借30 年(一直要工作到65岁), 利率2%, 每月还$3548。一旦利率涨到4%, 每月还贷 $4583。HDB租金收入抛去空置期,每月$2000。两厢抵, 每月要花$2000cash, 直到10年以后。这种前提是银行会借给960k。

2. 卖HDB,买 EC. 4 bedroom, 总价960k。首付200k,卖出HDB价格减去剩余HDB贷款=300k,所以贷款需要960-200-300=460k, 贷款25年,假设利息3%, 月付$2181,CPF可以cover95%,几乎不需要cash。

大家会选哪一种? -

#36

歪个楼问下现在买的新EC,明年建好,如果5年后再卖掉觉得还有这么多涨幅吗现在买的新EC,明年建好,如果5年后再卖掉觉得还有这么多涨幅吗

-

#37

好坏不知道。第一种情况,每月cash不用那么多吧按第二种情况所算,cpf还款没有算进去吧。按第二种情况所算,cpf还款没有算进去吧。

-

#39

接手HDB的那一方申请HDB贷款的条件是接手HDB的那一方申请HDB贷款的条件是

1. 你们现在的HDB是跟HDB贷款的. 如果不是的话,也就是说是跟银行贷款的,那么基本上很难做transfer了,只好还完银行贷款再打算,或者考虑其他的买房策略.

2. 你们家庭收入在$12000或以下,工薪族的话看最近三个月薪水.

然后能贷款多少就是看房子的估价(要重新做估计,四房组屋200块左右),接手一方的年龄和收入.接手HDB的那一方申请HDB贷款的条件是

1. 你们现在的HDB是跟HDB贷款的. 如果不是的话,也就是说是跟银行贷款的,那么基本上很难做transfer了,只好还完银行贷款再打算,或者考虑其他的买房策略.

2. 你们家庭收入在$12000或以下,工薪族的话看最近三个月薪水.

然后能贷款多少就是看房子的估价(要重新做估计,四房组屋200块左右),接手一方的年龄和收入. -

#40

CPF 利息退出HDB的人,他的CPF加利息全部回他的CPF OA. CPF加利息一共多少,www.cpf.gov.sg 可以查询退出HDB的人,他的CPF加利息全部回他的CPF OA. CPF加利息一共多少,www.cpf.gov.sg 可以查询

-

#41

如果是银行贷款,要还清.如果是HDB贷款,不一定要还清. 接手HDB的那一方符合条件也能申请HDB loan.

接手HDB的那一方申请HDB贷款的条件是

1. 你们现在的HDB是跟HDB贷款的. 如果不是的话,也就是说是跟银行贷款的,那么基本上很难做transfer了,只好还完银行贷款再打算,或者考虑其他的买房策略.

2. 你们家庭收入在$12000或以下,工薪族的话看最近三个月薪水.

然后能贷款多少就是看房子的估价(要重新做估计,四房组屋200块左右),接手一方的年龄和收入.如果是HDB贷款,不一定要还清. 接手HDB的那一方符合条件也能申请HDB loan.

接手HDB的那一方申请HDB贷款的条件是

1. 你们现在的HDB是跟HDB贷款的. 如果不是的话,也就是说是跟银行贷款的,那么基本上很难做transfer了,只好还完银行贷款再打算,或者考虑其他的买房策略.

2. 你们家庭收入在$12000或以下,工薪族的话看最近三个月薪水.

然后能贷款多少就是看房子的估价(要重新做估计,四房组屋200块左右),接手一方的年龄和收入. -

西芹妈 楼主#42

重新估价会对贷款有什么影响,我买的时候24万不到,我不是应该以这个屋价扣去我个人已经还过的,再申请贷款。ps:我目前是PR会对贷款有什么影响,我买的时候24万不到,我不是应该以这个屋价扣去我个人已经还过的,再申请贷款。ps:我目前是PR

-

#43

Pr就别搞了。pr出来还要交absd又是一笔现金

-

#44

你的房子价格比起你买的时候差不多或涨了,估价不怎么影响贷款如果房价跌了很多,那就会影响. 你是PR,不能申请HDB贷款啊. 我前面说的适用于双公民家庭. 当然,如果是SC+PR,HDB还是可以转给SC,然后PR去买公寓,出5%额外印花税,正常的印花税(无论身份都要给的)还是照样给.

-

西芹妈 楼主#45

汗难道要换国籍

-

#46

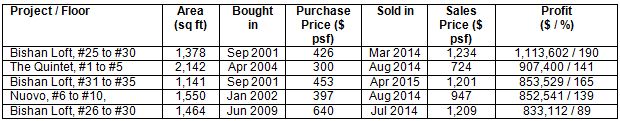

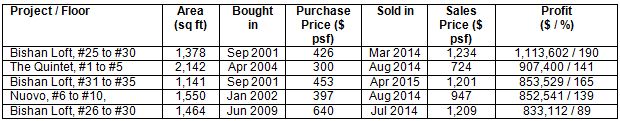

没赶上好时候http://www.theedgeproperty.com/content/ec-does-it-%E2%80%93-65-profit-margin-ec-sold-2014-2015 The highest profit of $1.1 million or 190% was traced to a unit at Bishan Loft (See Table 2). The owner had purchased the unit direct from developer NTUC Choice Homes and Chip Eng Leong back in 2001 for $426 psf. He sold it in March 2014 for $1,234 psf.

http://www.theedgeproperty.com/content/ec-does-it-%E2%80%93-65-profit-margin-ec-sold-2014-2015 The highest profit of $1.1 million or 190% was traced to a unit at Bishan Loft (See Table 2). The owner had purchased the unit direct from developer NTUC Choice Homes and Chip Eng Leong back in 2001 for $426 psf. He sold it in March 2014 for $1,234 psf.

-

#47

真是赚死了这人命好这人命好

-

#48

要说命好,D'Leedon的前身更夸张Farrer Court 2007年整体出售,618户每户分得200多万。

房子当时市价才50-60万。Farrer Court 2007年整体出售,618户每户分得200多万。

房子当时市价才50-60万。 -

#49

唉,怪不得很多新加坡很多人工资少还活的那么自信了发到这种财的真是命太好了发到这种财的真是命太好了

-

#50

09年后买房最多保值。。而且有风险接盘。

-

#51

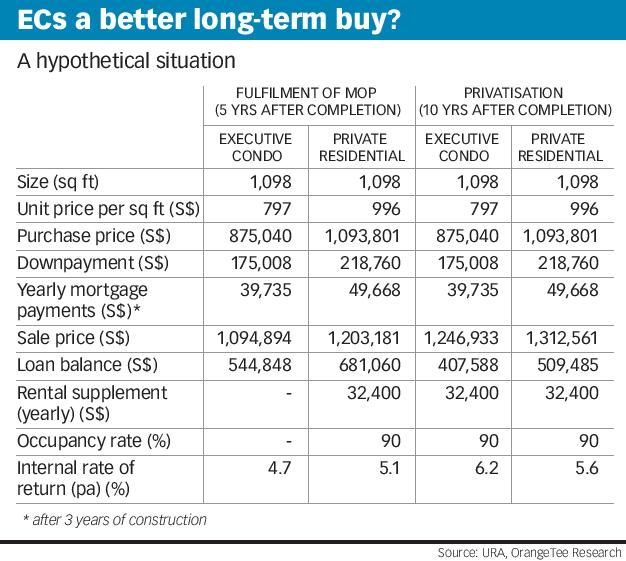

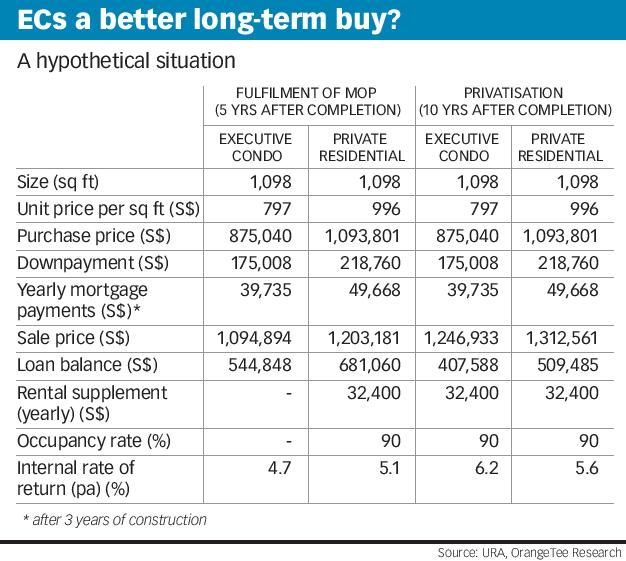

Are ECs a better long-term investment than condos?OrangeTee study suggests they are, and makes a case for executive condos as an investment home

By Lee Meixian[email protected]@LeeMeixianBT

PRICES of executive condominiums (ECs) do catch up with private condos after the initial five-year minimum occupation period (MOP), and even more so when they are fully privatised 10 years after purchase.

A study by OrangeTee has found that the average price gap between new condos and ECs starts at around 20 per cent, due to the sales restrictions that apply to ECs, as well as their lower land and construction costs.

But upon fulfilling the MOP and at privatisation, the discount narrows to 9 per cent and 5 per cent respectively.

At the end of the MOP, ECs can be sold in the open market to Singaporeans and permanent residents; upon privatisation, ECs can be sold to foreigners.

This is not to say that buying an EC is a sure-profit investment, as history shows that much still depends on the initial purchase price.

By matching caveats at 21 EC projects already privatised and analysing their profits made at the end of five and 10 years, the study found that 13 projects made a loss after five years, mostly because they were bought at the boom period before the Asian financial crisis. The remaining eight projects managed gains of over 20 per cent.

But at privatisation, all the EC projects became profitable. How much money owners made depended on the ECs' locational attributes and surrounding supply at the time of sale.

"Based on historical data, first-hand owners of currently privatised ECs are sitting on considerable gains," the report said.

The report also alluded to a trend that The Business Times had highlighted in an article in January - that increased vacancy rates may be a sign that buyers are starting to treat ECs as an investment product, as young-couple EC buyers continue to live with their parents after marriage while waiting for EC prices to re-calibrate over time before they sell.

OrangeTee said this trend is plausible. But its study found something even more surprising. Comparing between buying an EC and a private condo and holding each for 10 years, the report said that the EC could in fact be the better long-term investment due to their higher internal rates of return over 10 years.

This is because of their subsidies and lower prices compared to private condos. Also from year six onwards, entire EC units are allowed to be rented out, and their rentals tend to be on a par with private condos'. This helps to significantly defray their holding costs.

The hypothetical study assumed a 1,100-square-foot EC home bought for S$875,000, and a comparable condo for S$1.09 million.

The hypothetical couple has a household income of S$14,000, with a not very financially prudent loan-to-value of 80 per cent for 25 years at a fixed rate of 2.5 per cent per annum.

Rents for both units are fixed at S$3,000 per month. To simplify matters, other costs such as stamp duties, maintenance fees, and taxes were not considered.

At the end of just five years, the private condo proved to be the better buy, because the EC was not able to offset its monthly mortgage payments with rental income, as regulations forbid renting out the whole unit. This dampened its otherwise stellar capital appreciation.

But once rental restrictions are lifted, the EC quickly outperformed the condo.

Asked if the findings, which support an investment case for ECs, mean that the partly state-subsidised housing designed for the "sandwiched class" home buyer has become irrelevant, OrangeTee's research analyst Celine Chan said no.

"(This is) given the significant price gap between ECs and private condos. ECs provide an affordable option to HDB upgraders or first timers who aspire to achieve a higher standard of living. Though some may plausibly be buying ECs for investment, majority are buying them for their own occupation," she said.

OrangeTee study suggests they are, and makes a case for executive condos as an investment home

By Lee Meixian[email protected]@LeeMeixianBT

PRICES of executive condominiums (ECs) do catch up with private condos after the initial five-year minimum occupation period (MOP), and even more so when they are fully privatised 10 years after purchase.

A study by OrangeTee has found that the average price gap between new condos and ECs starts at around 20 per cent, due to the sales restrictions that apply to ECs, as well as their lower land and construction costs.

But upon fulfilling the MOP and at privatisation, the discount narrows to 9 per cent and 5 per cent respectively.

At the end of the MOP, ECs can be sold in the open market to Singaporeans and permanent residents; upon privatisation, ECs can be sold to foreigners.

This is not to say that buying an EC is a sure-profit investment, as history shows that much still depends on the initial purchase price.

By matching caveats at 21 EC projects already privatised and analysing their profits made at the end of five and 10 years, the study found that 13 projects made a loss after five years, mostly because they were bought at the boom period before the Asian financial crisis. The remaining eight projects managed gains of over 20 per cent.

But at privatisation, all the EC projects became profitable. How much money owners made depended on the ECs' locational attributes and surrounding supply at the time of sale.

"Based on historical data, first-hand owners of currently privatised ECs are sitting on considerable gains," the report said.

The report also alluded to a trend that The Business Times had highlighted in an article in January - that increased vacancy rates may be a sign that buyers are starting to treat ECs as an investment product, as young-couple EC buyers continue to live with their parents after marriage while waiting for EC prices to re-calibrate over time before they sell.

OrangeTee said this trend is plausible. But its study found something even more surprising. Comparing between buying an EC and a private condo and holding each for 10 years, the report said that the EC could in fact be the better long-term investment due to their higher internal rates of return over 10 years.

This is because of their subsidies and lower prices compared to private condos. Also from year six onwards, entire EC units are allowed to be rented out, and their rentals tend to be on a par with private condos'. This helps to significantly defray their holding costs.

The hypothetical study assumed a 1,100-square-foot EC home bought for S$875,000, and a comparable condo for S$1.09 million.

The hypothetical couple has a household income of S$14,000, with a not very financially prudent loan-to-value of 80 per cent for 25 years at a fixed rate of 2.5 per cent per annum.

Rents for both units are fixed at S$3,000 per month. To simplify matters, other costs such as stamp duties, maintenance fees, and taxes were not considered.

At the end of just five years, the private condo proved to be the better buy, because the EC was not able to offset its monthly mortgage payments with rental income, as regulations forbid renting out the whole unit. This dampened its otherwise stellar capital appreciation.

But once rental restrictions are lifted, the EC quickly outperformed the condo.

Asked if the findings, which support an investment case for ECs, mean that the partly state-subsidised housing designed for the "sandwiched class" home buyer has become irrelevant, OrangeTee's research analyst Celine Chan said no.

"(This is) given the significant price gap between ECs and private condos. ECs provide an affordable option to HDB upgraders or first timers who aspire to achieve a higher standard of living. Though some may plausibly be buying ECs for investment, majority are buying them for their own occupation," she said.