日本央行决定引进负利率

明年今日 • • 50598 次浏览在29日的货币政策决定会议上,日本央行暂缓额外的货币宽松,讨论引进负利率政策。在原油下跌,中国经济放缓下世界经济前景不安的情况下,日本国内经济和物价下行可能性增强。如果企业采取谨慎态度,工资增长和资本投资刹车,经济的良性循环不再,日本央行的2 %通胀目标达成堪忧。。。

http://www.nikkei.com/article/DGXLASDF29H01_Z20C16A1000000/?dg=1

---

-

#1

嚓,那不是意思就说别存钱了?

-

明年今日 楼主#2

是啊。欧洲已经是了,日本现在也是,美国可能一年左右也这样。变相的现金稅。[…]非得逼人去赌博。。。非得逼人去赌博。。。

-

明年今日 楼主#3

然并卵。上升700点,再回落800点。

-

#4

负利息是对银行将钱放在中央银行而言。其目的是让银行多担当一点风险把钱贷出去

-

明年今日 楼主#5

然后又上升了800点。欧洲日本5年利率都已经是负数。美国国库券成为最后一片乐土。美国国库券成为最后一片乐土。

-

明年今日 楼主#6

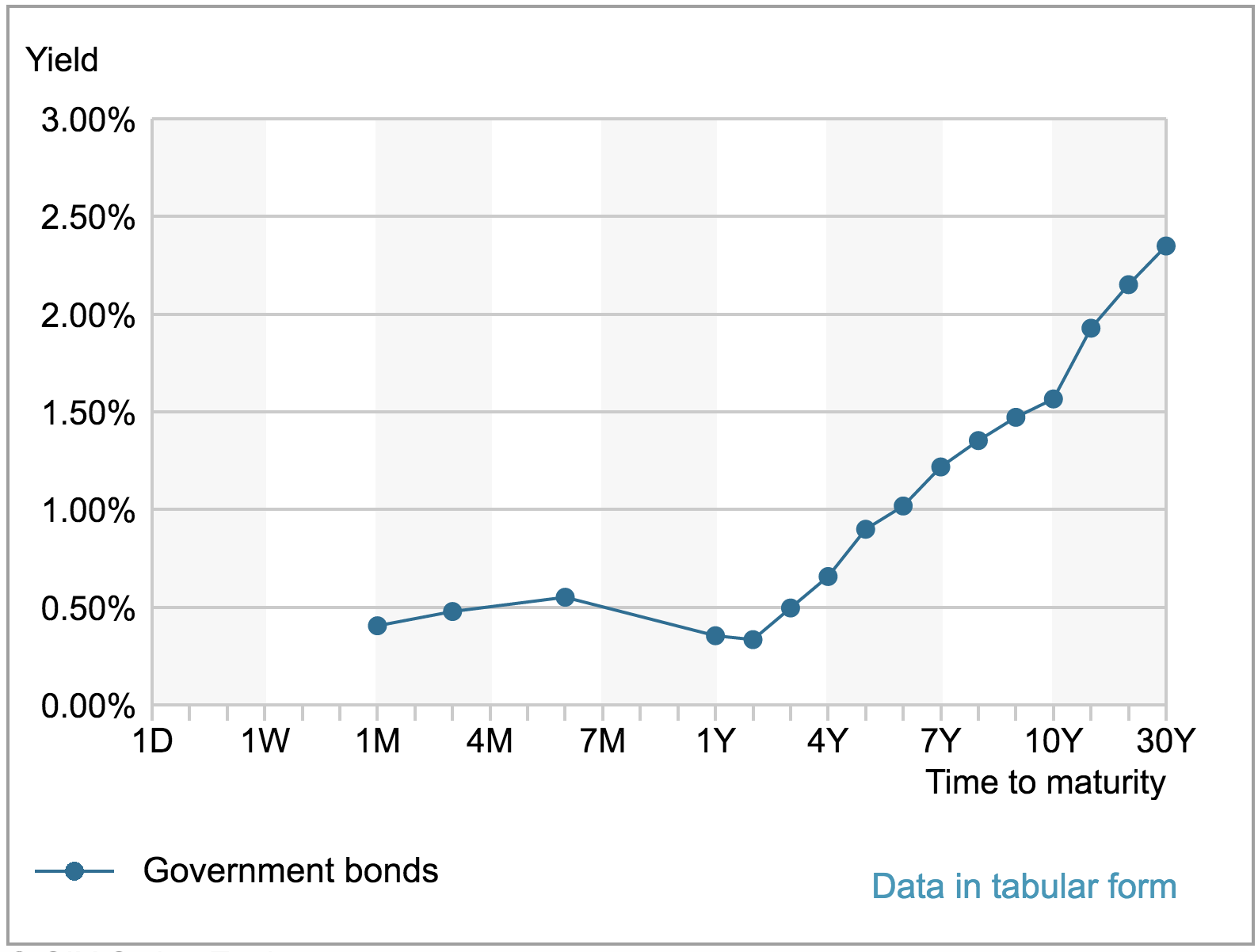

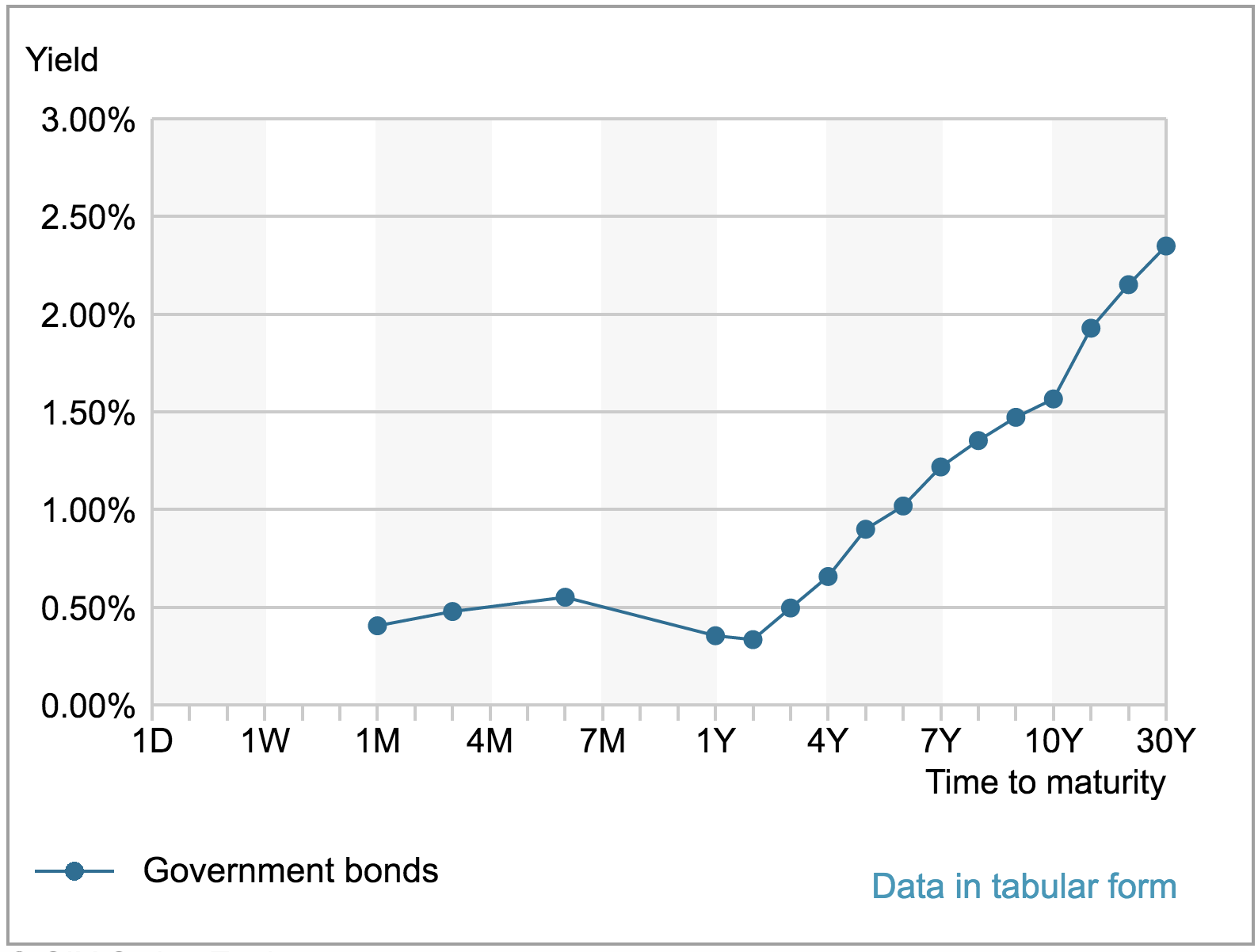

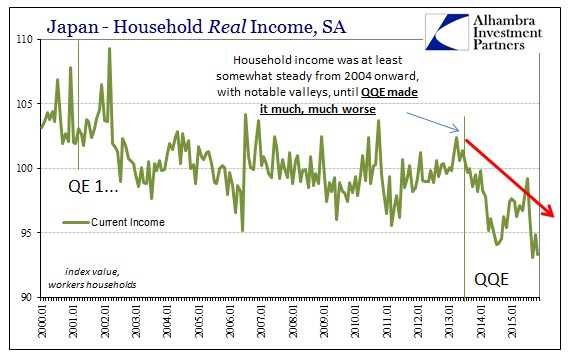

昨日之后的主要利率曲线瑞士

德国

日本

英国

美国

美国利率一枝独秀,令美国国库券成为天堂。

瑞士

德国

日本

英国

美国

美国利率一枝独秀,令美国国库券成为天堂。

-

明年今日 楼主#7

美元见顶危险解除继续上升 -> 环球股市大涨

蓝线:美元对日元,红线:标普500

蓝线:美元对日元,红线:标普500

-

明年今日 楼主#8

美元见顶危险解除继续上升 -> 又可尽情买SKII,小金瓶,JR Pass了

-

明年今日 楼主#9

美国利率一枝独秀 -> 国库券,公用股大放光彩国库券ETF

道琼斯公用股指数

国库券ETF

道琼斯公用股指数

-

#10

前一阵子叫嚣换美元的,如今作何感想。

-

明年今日 楼主#11

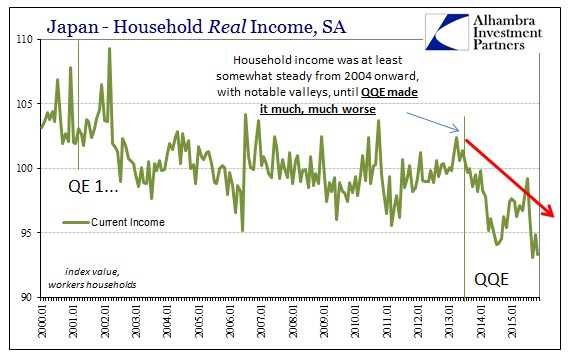

安倍经济学短短三年让日本GDP从6.154T跌到4.098T美元

QE和负利率的直接结果就是自废武功(购买力)。当主要经济体一起QE/负利率的时候,世界经济就辗转向下。百业萧条之下,唯有赌博。

QE和负利率的直接结果就是自废武功(购买力)。当主要经济体一起QE/负利率的时候,世界经济就辗转向下。百业萧条之下,唯有赌博。

-

明年今日 楼主#12

日本央行行动原因猜测 - 炒股失败不肯认输

前几天日经指数回落到2014年10月31日QQE2时的水平。如果不刺激一下,QQE2买的ETF全赔钱了,这可能是一大诱因。

日本央行持有日本ETF市场的52%。

前几天日经指数回落到2014年10月31日QQE2时的水平。如果不刺激一下,QQE2买的ETF全赔钱了,这可能是一大诱因。

日本央行持有日本ETF市场的52%。

-

明年今日 楼主#13

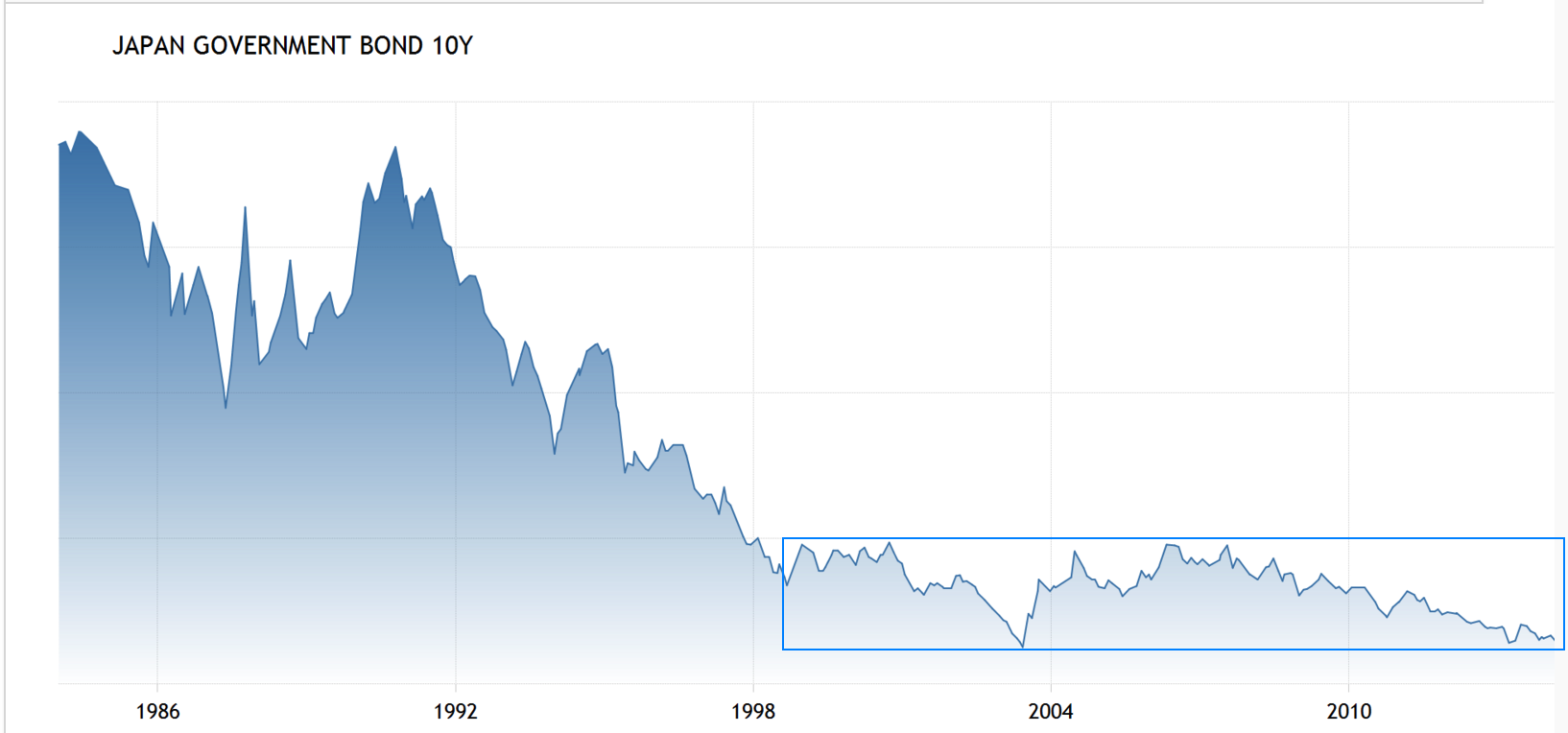

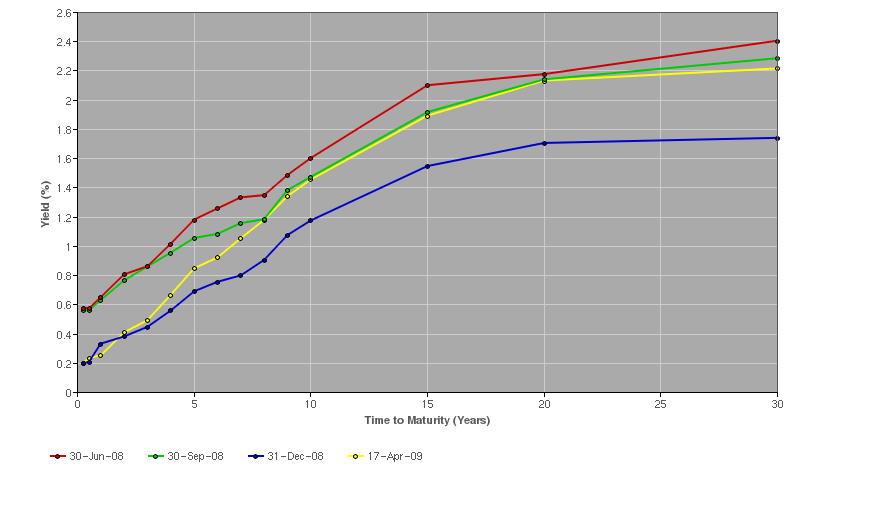

不要乱卖空的一个典型例子:日本国库券日本国库券利率 (利率越低,价钱越高)

从2000年开始,有无数人看跌日本国库券(打赌日本利率上升),结果到了今天日本国库券利率走向0(价格继续上升)。

终有一天日本利率会上升,但是过早根据理论卖空日本国库券的可能已经输得底裤不保。

日本国库券利率 (利率越低,价钱越高)

从2000年开始,有无数人看跌日本国库券(打赌日本利率上升),结果到了今天日本国库券利率走向0(价格继续上升)。

终有一天日本利率会上升,但是过早根据理论卖空日本国库券的可能已经输得底裤不保。

-

明年今日 楼主#14

5年前的故事

Japan’s widow-maker bond trade still looks lethal

By Wayne Arnold June 6, 2011

TOKYO — Bond traders have been betting against Japanese government debt for years — and losing spectacularly. Victims of the so-called “widow-maker” trade of shorting JGBs thought the March disaster would vindicate them. Rebuilding, after all, will add to Japan’s sky-high debt and, with a shrinking workforce and rising pension costs, push yields up. But the quake hasn’t disrupted the self-perpetuating money machine that drives JGBs. Doomsayers still run the risk of becoming road kill.

JGBs have outperformed U.S. and German bonds over the past five years, returning over 55 percent in dollar terms, according to Merrill Lynch, despite yielding less than 2 percent. Much of this is a function of the yen’s appreciation against the dollar. But short-sellers have also been flummoxed by the surprising way that a government with debt twice the size of its economy has managed not just to avoid a Greek-style blowout, but to borrow more cheaply every year.

All but 5 percent of JGBs are held by Japanese, not foreigners demanding attractive yields. Japanese who balked at low yields and invested elsewhere have been punished. At home, stocks have halved since 2005 and the yen’s climb has sapped gains offshore.

Japan’s pension funds accumulate long-term JGBs to match their liabilities. So, too, do insurers. Banks are the largest JGB buyers by far, a fact unlikely to change unless the economy revs up. With growth anemic and prices falling, companies are paying off loans and socking cash into bank accounts rather than investing it. With worthy borrowers scarce, banks park these deposits into JGBs.

Even if Japan’s economy does miraculously revive, inflation and growth would offset higher borrowing costs by boosting tax revenue. The real concern, then, is whether demographics might derail the JGB engine. As the workforce shrinks and the ranks of retirees grow, pension funds might need to sell JGBs. The government’s funding needs would then rise as income taxes decline.

Even without fiscal reforms, though, Japan isn’t likely to reach this tipping point for at least years — seemingly plenty of time to get its house in order, cut benefits, raise contributions and taxes to avert a crunch. True, Japan’s politicians — including Prime Minister Naoto Kan, who survived a no-confidence vote on Thursday — demonstrate a paucity of leadership to tackle these problems. But that’s still enough time to make a few more widows out of those betting against Japanese government debt.

Japan’s widow-maker bond trade still looks lethal

By Wayne Arnold June 6, 2011

TOKYO — Bond traders have been betting against Japanese government debt for years — and losing spectacularly. Victims of the so-called “widow-maker” trade of shorting JGBs thought the March disaster would vindicate them. Rebuilding, after all, will add to Japan’s sky-high debt and, with a shrinking workforce and rising pension costs, push yields up. But the quake hasn’t disrupted the self-perpetuating money machine that drives JGBs. Doomsayers still run the risk of becoming road kill.

JGBs have outperformed U.S. and German bonds over the past five years, returning over 55 percent in dollar terms, according to Merrill Lynch, despite yielding less than 2 percent. Much of this is a function of the yen’s appreciation against the dollar. But short-sellers have also been flummoxed by the surprising way that a government with debt twice the size of its economy has managed not just to avoid a Greek-style blowout, but to borrow more cheaply every year.

All but 5 percent of JGBs are held by Japanese, not foreigners demanding attractive yields. Japanese who balked at low yields and invested elsewhere have been punished. At home, stocks have halved since 2005 and the yen’s climb has sapped gains offshore.

Japan’s pension funds accumulate long-term JGBs to match their liabilities. So, too, do insurers. Banks are the largest JGB buyers by far, a fact unlikely to change unless the economy revs up. With growth anemic and prices falling, companies are paying off loans and socking cash into bank accounts rather than investing it. With worthy borrowers scarce, banks park these deposits into JGBs.

Even if Japan’s economy does miraculously revive, inflation and growth would offset higher borrowing costs by boosting tax revenue. The real concern, then, is whether demographics might derail the JGB engine. As the workforce shrinks and the ranks of retirees grow, pension funds might need to sell JGBs. The government’s funding needs would then rise as income taxes decline.

Even without fiscal reforms, though, Japan isn’t likely to reach this tipping point for at least years — seemingly plenty of time to get its house in order, cut benefits, raise contributions and taxes to avert a crunch. True, Japan’s politicians — including Prime Minister Naoto Kan, who survived a no-confidence vote on Thursday — demonstrate a paucity of leadership to tackle these problems. But that’s still enough time to make a few more widows out of those betting against Japanese government debt.

-

#15

不是的,因为不针对个人储蓄只针对商业银行在央行的储备金只针对商业银行在央行的储备金

-

#16

黑田火箭筒名副其实黑田行长很黑啊,呵呵,一箭三雕,刺激通胀,支持美元升值,促进人民币贬值。

再深一层,第一点是日本国内的讲政治,表面文章; 第二点,是国际上的讲政治,一半实际,一半虚;第三点是打在实处了。潜台词是,当年日本深受欧美货币之害,目前岂能让邻国幸免。这次,日本是站在了上次欧美的位置了。

但,与天朝打仗,不管是军事,还是经济,不能照常规思路的,大家拭目以待吧。

黑田行长很黑啊,呵呵,一箭三雕,刺激通胀,支持美元升值,促进人民币贬值。

再深一层,第一点是日本国内的讲政治,表面文章; 第二点,是国际上的讲政治,一半实际,一半虚;第三点是打在实处了。潜台词是,当年日本深受欧美货币之害,目前岂能让邻国幸免。这次,日本是站在了上次欧美的位置了。

但,与天朝打仗,不管是军事,还是经济,不能照常规思路的,大家拭目以待吧。 -

明年今日 楼主#17

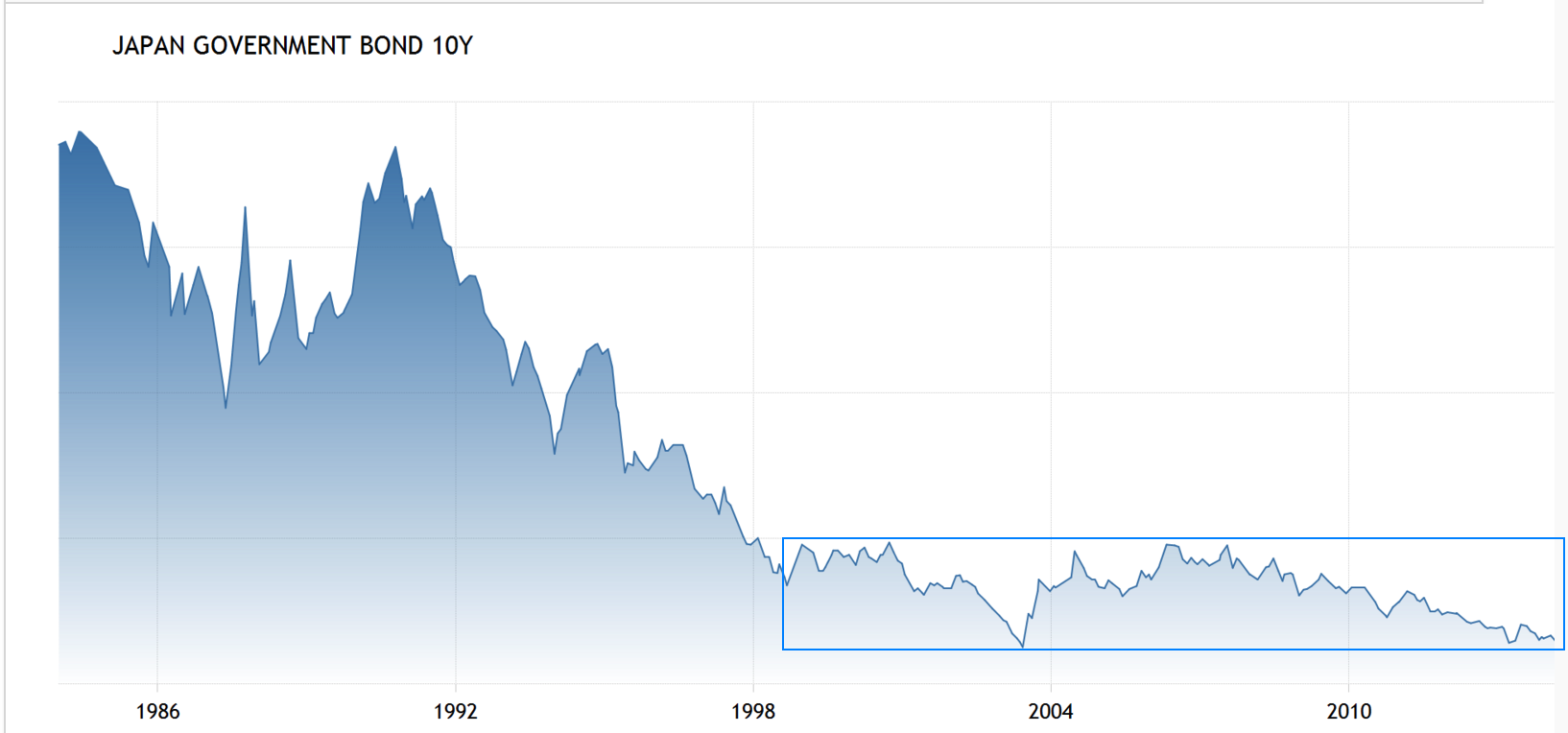

日本QQE三枝箭

1. 家庭收入

2. 储蓄 (无风险存近十年负利息,红线)

3. 股票 - 最知名企业日本邮政(等同POSB)破发

1. 家庭收入

2. 储蓄 (无风险存近十年负利息,红线)

3. 股票 - 最知名企业日本邮政(等同POSB)破发

-

#18

国库卷是固定收益吧。。。只是相比于银行利率到0,略高而已如果看跌日本货币,卖出国库卷应该也没问题?如果看跌日本货币,卖出国库卷应该也没问题?

-

明年今日 楼主#19

利率越负,日元越升股票越跌的原因当央行说利率会越来越负时,就是保证债券会不断升。本来市场上是卖债券买股票,现在得到央行保证,马上变成买债券卖股票。借日元买股票的变成卖股票还日元。

所以昨晚瑞典央行降息到-0.5%,股市马上下跌。黑田早上一说话,股市也是下跌。

基本上过去几年的市场形势正在逆转,比如说因烟雾被笑话的,因为一度跌穿3被笑话的,都是最强势市场。当央行说利率会越来越负时,就是保证债券会不断升。本来市场上是卖债券买股票,现在得到央行保证,马上变成买债券卖股票。借日元买股票的变成卖股票还日元。

所以昨晚瑞典央行降息到-0.5%,股市马上下跌。黑田早上一说话,股市也是下跌。

基本上过去几年的市场形势正在逆转,比如说因烟雾被笑话的,因为一度跌穿3被笑话的,都是最强势市场。 -

#20

如果现在卖日元,卖日本国债,为毛日币升值那么厉害?

-

#21

说明有短期热钱流入日本热钱流入日本