Old Chang Kee 会不会变成第二个BreadTalk?

叫什么好呢 • • 65752 次浏览一直觉得Old Chang Kee和BreadTalk的Business Model很像,都是可以在短时间内复制连锁开遍地的。 虽然Old Chang Kee没有BreadTalk规模大,但是它的Profit Margin却相当于BreadTalk的两倍。但不确定它是不是局限于当地文化,首推咖喱饺,旗下的小吃店也以当地特色为主。不像BreadTalk打着面包中的高大上旗号走红亚洲。而且油炸食品总觉得不益健康。但是Old Chang Kee却有它的忠实粉丝。晚上经常看到所剩食物寥寥无几。股票走势一直很健康,属于稳扎稳打型。由于BreadTalk最近琦火箭往上窜,已经不敢碰了。此时买进Old Chang Kee会是一个好选择么?看那些Financial ratio感觉好像价格已经很高了,不适合进吧。请牛人指点迷津!

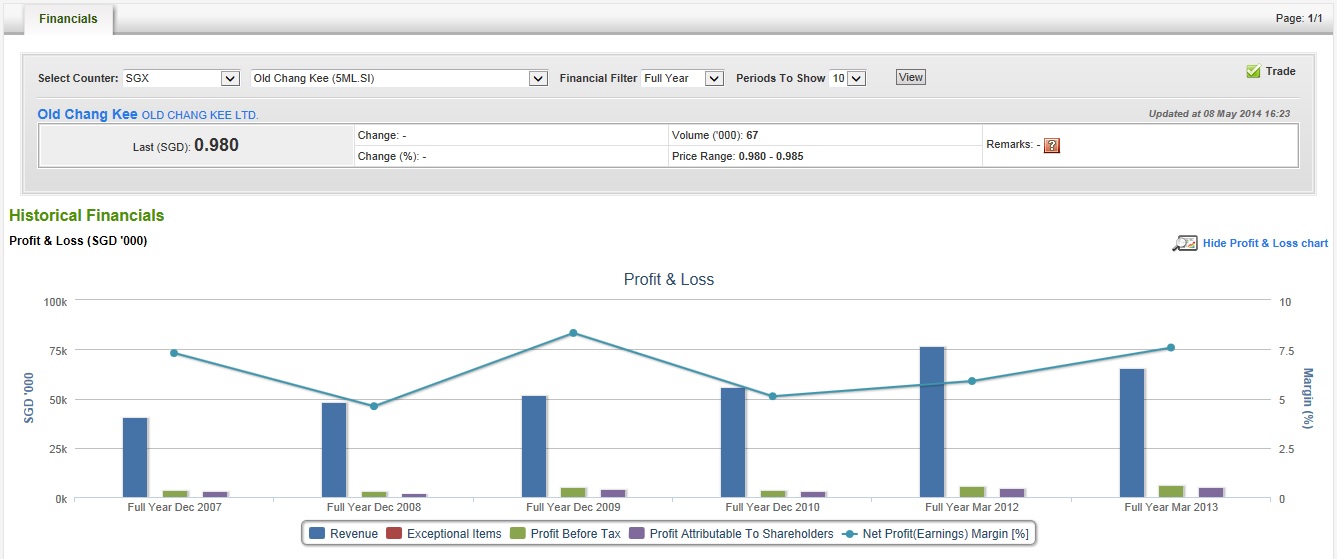

从Shareinvestor复制的OldChangKeep资料共大家参考。

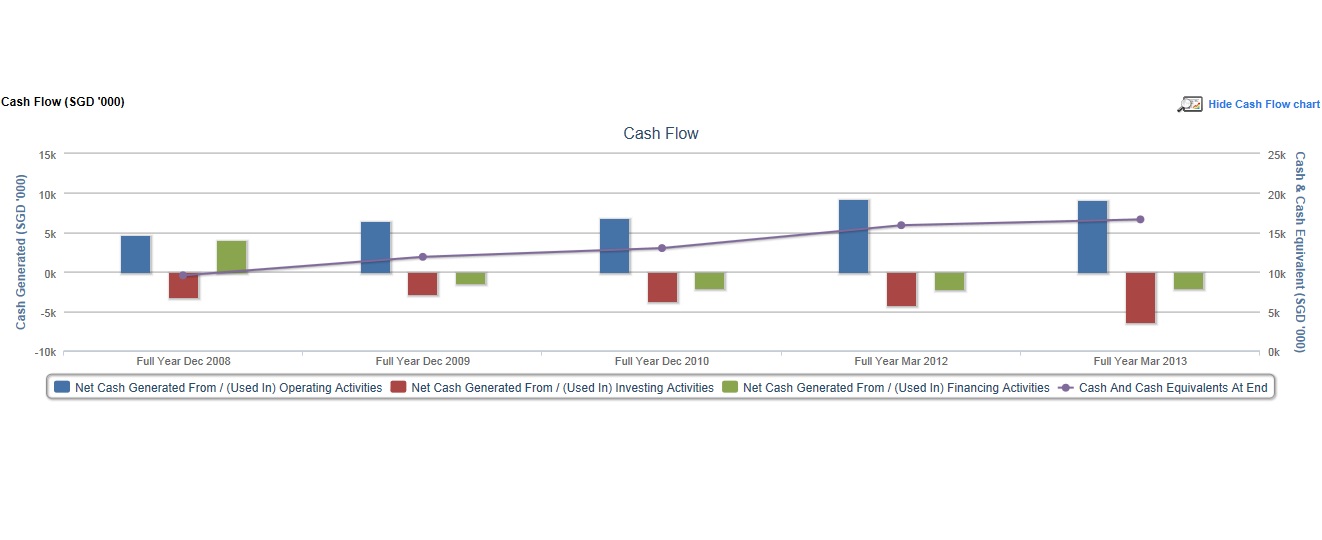

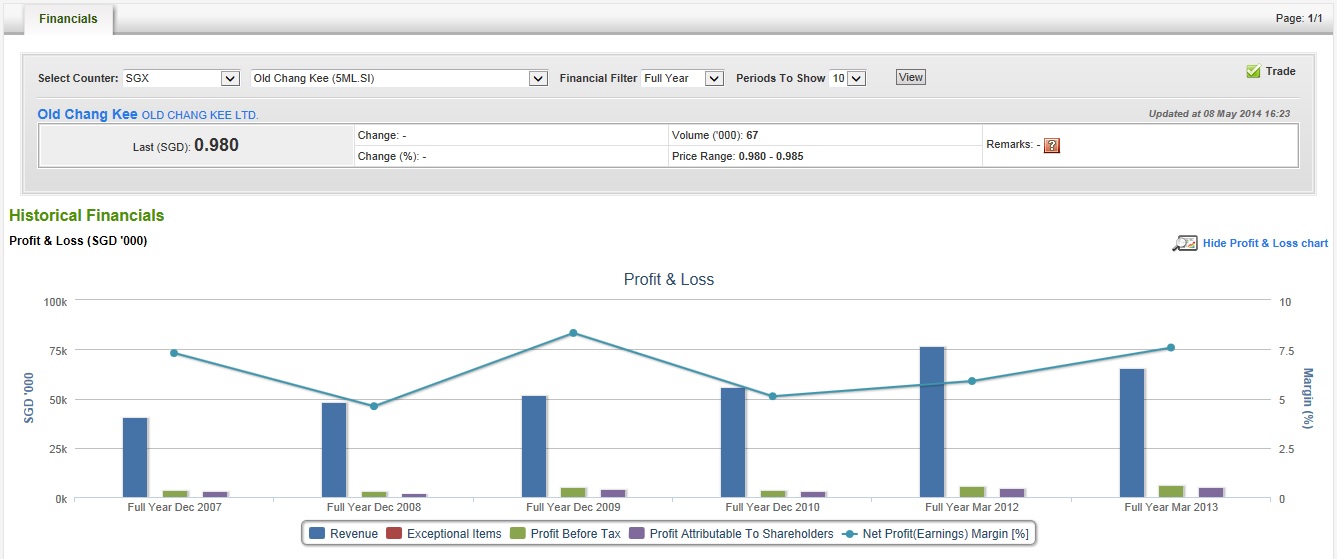

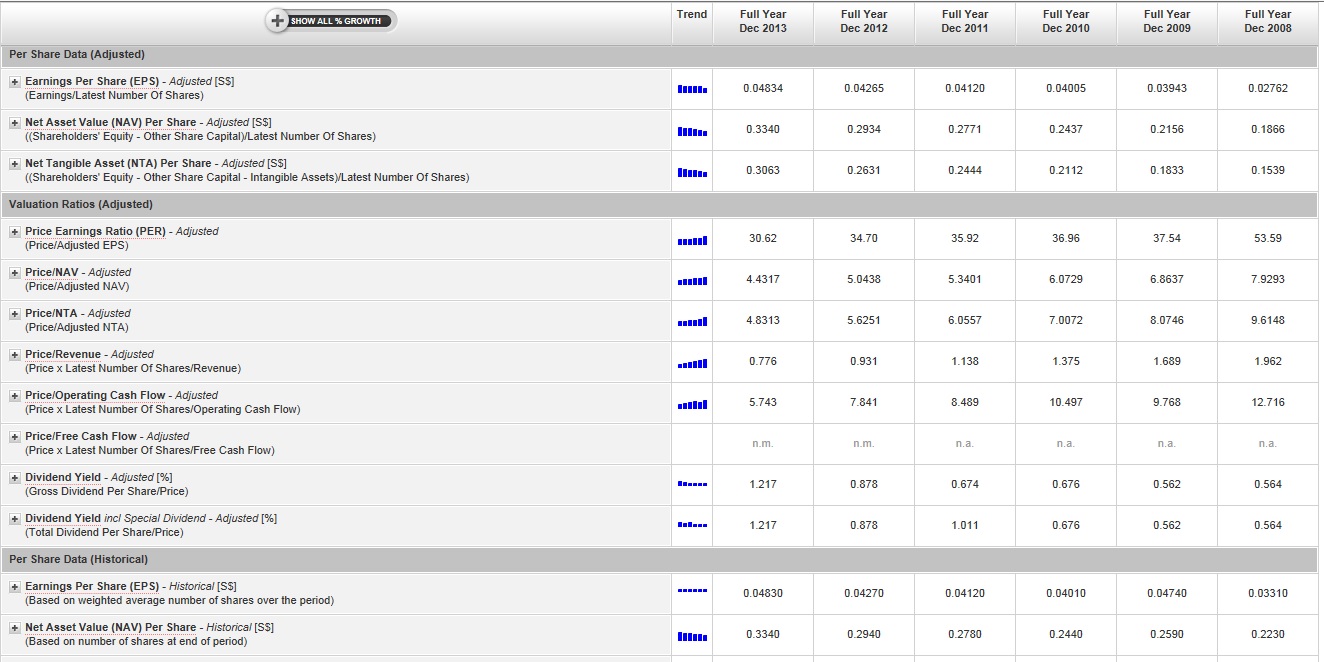

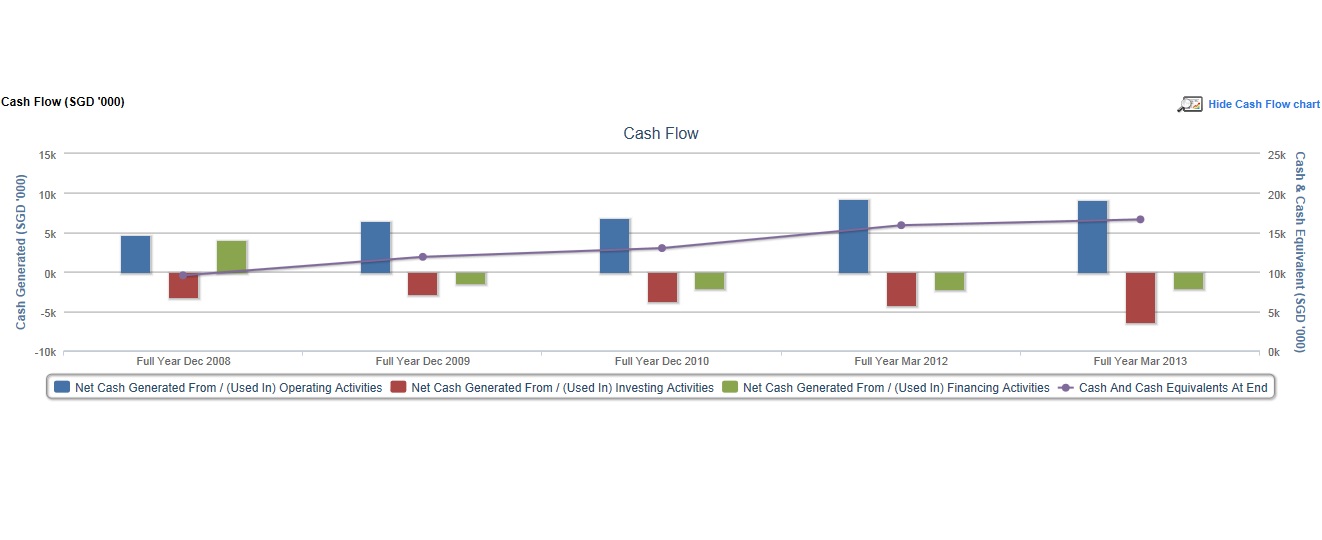

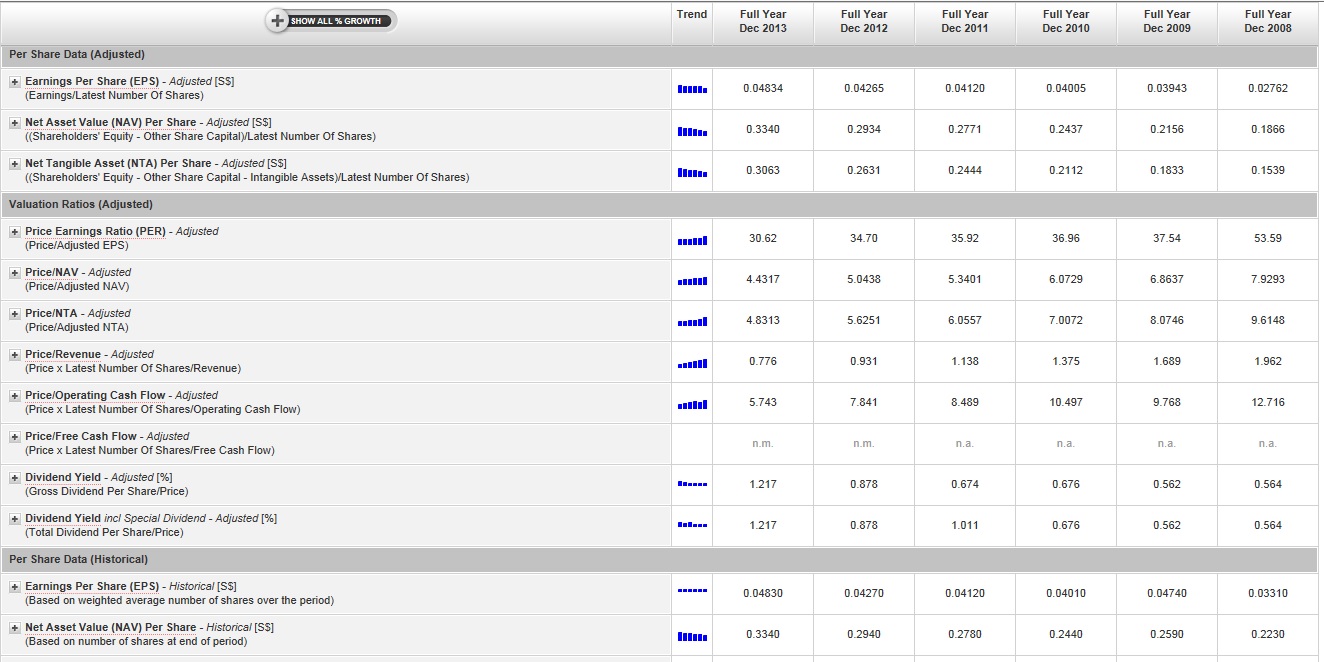

Historical FinancialsProfit & Loss (SGD '000)Hide Profit & Loss chartCreated with Highstock 1.3.9SGD '000Margin (%)Profit & LossRevenueExceptional ItemsProfit Before TaxProfit Attributable To ShareholdersNet Profit(Earnings) Margin [%Cash Flow (SGD '000)Hide Cash Flow chartCreated with Highstock 1.3.9Cash Generated (SGD '000)Cash & Cash Equivalent (SGD '000)Cash FlowNet Cash Generated From / (Used In) Operating ActivitiesNet Cash Generated From / (Used In) Investing ActivitiesNet Cash Generated From / (Used In) Financing ActivitiesCash And Cash Equivalents At EndFull Year Dec 2008Full Year Dec 2009Full Year Dec 2010Full Year Mar 2012Full Year Mar 2013-10k-5k0k5k10k15k0k5k10k15k20k25kFull Year Mar 2012Net Cash Generated From / (Used In) Investing Activities: -4,221 Per Share Data (Adjusted)[+]Earnings Per Share (EPS)- Adjusted [S$]

(Earnings/Latest Number Of Shares) 0.048340.042650.041200.040050.039430.02762Period-on-Period % Growth- Adjusted +13.33%+3.52%+2.89%+1.57%+42.75%n.a.[+]Net Asset Value (NAV) Per Share- Adjusted [S$]

((Shareholders' Equity - Other Share Capital)/Latest Number Of Shares) 0.33400.29340.27710.24370.21560.1866Period-on-Period % Growth- Adjusted +13.81%+5.87%+13.72%+13.02%+15.52%n.a.[+] Net Tangible Asset (NTA) Per Share- Adjusted [S$]

((Shareholders' Equity - Other Share Capital - Intangible Assets)/Latest Number Of Shares) 0.30630.26310.24440.21120.18330.1539Period-on-Period % Growth- Adjusted +16.43%+7.65%+15.71%+15.23%+19.07%n.a.Valuation Ratios (Adjusted)[+]Price Earnings Ratio (PER)- Adjusted

(Price/Adjusted EPS) 30.6234.7035.9236.9637.5453.59Period-on-Period % Growth- Adjusted -11.76%-3.40%-2.81%-1.54%-29.95%n.a.[+]Price/NAV- Adjusted

(Price/Adjusted NAV) 4.43175.04385.34016.07296.86377.9293Period-on-Period % Growth- Adjusted -12.14%-5.55%-12.07%-11.52%-13.44%n.a.[+] Price/NTA- Adjusted

(Price/Adjusted NTA) 4.83135.62516.05577.00728.07469.6148Period-on-Period % Growth- Adjusted -14.11%-7.11%-13.58%-13.22%-16.02%n.a.[+]Price/Revenue- Adjusted

(Price x Latest Number Of Shares/Revenue) 0.7760.9311.1381.3751.6891.962Period-on-Period % Growth- Adjusted -16.62%-18.20%-17.22%-18.62%-13.89%n.a.[+]Price/Operating Cash Flow- Adjusted

(Price x Latest Number Of Shares/Operating Cash Flow) 5.7437.8418.48910.4979.76812.716Period-on-Period % Growth- Adjusted -26.76%-7.64%-19.12%+7.46%-23.19%n.a.[+] Price/Free Cash Flow- Adjusted

(Price x Latest Number Of Shares/Free Cash Flow) n.m.n.m.n.a.n.a.n.a.n.a.Period-on-Period % Growth- Adjusted n.a.n.a.n.a.n.a.n.a.n.a.[+]Dividend Yield- Adjusted [%]

(Gross Dividend Per Share/Price) 1.2170.8780.6740.6760.5620.564Period-on-Period % Growth- Adjusted +38.68%+30.19%-0.23%+20.25%-0.41%n.a.[+]Dividend Yieldincl Special Dividend - Adjusted [%]

(Total Dividend Per Share/Price) 1.2170.8781.0110.6760.5620.564Period-on-Period % Growthincl Special Dividend - Adjusted +38.68%-13.21%+49.65%+20.25%-0.41%n.a.Per Share Data (Historical)[+]Earnings Per Share (EPS)- Historical [S$]

(Based on weighted average number of shares over the period) 0.048300.042700.041200.040100.047400.03310Period-on-Period % Growth- Historical +13.11%+3.64%+2.74%-15.40%+43.20%n.a.[+]Net Asset Value (NAV) Per Share- Historical [S$]

(Based on number of shares at end of period) 0.33400.29400.27800.24400.25900.2230Period-on-Period % Growth- Historical +13.61%+5.76%+13.93%-5.79%+16.14%n.a.[+] Net Tangible Asset (NTA) Per Share- Historical [S$]

(Based on number of shares at end of period) 0.30610.26340.24500.21120.22040.1843Period-on-Period % Growth- Historical +16.25%+7.50%+15.98%-4.17%+19.57%n.a.Valuation Ratios (Historical)

-

叫什么好呢 楼主#1

复制粘贴出来的东东太吓人了!发帖的时候明明是这样的!

-

#2

没研究过这两个,不过听说面包无语不靠面包赚钱。鼎泰丰什么的才是摇钱树。。。

还有他的拉面,吐司什么的。

老曾记没法比吧。老曾记有什么呢?

真的没看过这两个股票,瞎说而已才是摇钱树。。。

还有他的拉面,吐司什么的。

老曾记没法比吧。老曾记有什么呢?

真的没看过这两个股票,瞎说而已 -

叫什么好呢 楼主#3

Breadtalk有鼎泰丰,toast box,拉面玩家,大时代。接下来他们还会往房地产发展。老曾记有Curry Times, Mushroom Café, Take 5 and the Pie Kia shops只是更地方话,规模小,咱们不经常见。鼎泰丰,toast box,拉面玩家,大时代。接下来他们还会往房地产发展。老曾记有Curry Times, Mushroom Café, Take 5 and the Pie Kia shops只是更地方话,规模小,咱们不经常见。

-

#4

应该都是政府扶持的吧听人讲起本地的政府扶持这种企业走国际化路线。以后应该会转移项目做其他的。听人讲起本地的政府扶持这种企业走国际化路线。以后应该会转移项目做其他的。

-

#5

说到国际化想起了老曾记在成都的悲惨下场……想起了老曾记在成都的悲惨下场……

-

#6

面包无语在中国的店面总是排着队伍,粗且长。几年前大概是2008年我看他报表,称中国业务占了一半。

你仔细看,会发现,凡是大购物中心,有面包无语的,一定有他家旗下的很多牌子,凑在一起,形成一个生态群落,吸引任何口味的人去吃。

例如面包无语+土司作坊+大时代+鼎泰丰+拉面玩家+Wendy's。。。。

老曾家,不知道有没有这个路数。几年前大概是2008年我看他报表,称中国业务占了一半。

你仔细看,会发现,凡是大购物中心,有面包无语的,一定有他家旗下的很多牌子,凑在一起,形成一个生态群落,吸引任何口味的人去吃。

例如面包无语+土司作坊+大时代+鼎泰丰+拉面玩家+Wendy's。。。。

老曾家,不知道有没有这个路数。 -

#7

成都我觉得选址不对一线城市更好些。一线城市更好些。

-

叫什么好呢 楼主#8

老曾家走的地方特色路线走不了高大上的国际路线。实力也不比Breadtalk.但他们的价格在Breadtalk 坐火箭前很接近.而且老曾记一直很稳走不了高大上的国际路线。实力也不比Breadtalk.但他们的价格在Breadtalk 坐火箭前很接近.而且老曾记一直很稳